A Winter to Remember

It surprised everyone.

Two mild winters, followed by a record cold winter. The last time it was colder in Boston on December 16 was in 1883.

How bad is it?

My best guess is that our Northeast propane community will require about 200 million gallons of spot propane supply to meet this winter’s demand. That may seem like a staggering shortfall, but I don't think I'm wrong by too much on that figure.

How can we make up that deficit?

The only places in the Northeast that have large quantities of wet gallon storage, or the ability to import massive quantities of propane into the region fairly quickly, are the storage caverns in the Finger Lakes region and the Sea-3 terminal in NH.

Months ago, Ray Energy secured large quantities of winter-only propane supply at these storage locations to help in the event of a supply interruption and to meet our customers’ incremental winter supply needs. We’re still securing extra propane supply and transportation on a daily basis. But given the sheer volume of the spot supply deficit that our industry faces now, it may take another six weeks before the additional supply that’s required for this winter gets fully distributed throughout the system.

What have been the challenges?

Northeast pipeline supply was affected by PA and WV gas plant production issues in December and January. Rail shipments were delayed by holiday weekends and shortages of available railcars, while frigid temperatures affected locomotive engines and train lengths. The marine terminal couldn’t schedule a large January ship in sooner (wouldn’t fit) because the record cold temperatures impacted everyone so suddenly that demand at the terminal went from near zero to off-the-charts crazy in a matter of days.

And now we have damage to a vital railroad bridge (ice jam?) in Quebec affecting rail traffic into Maine with minimum re-routing delays of three to five days. Repairs may take several months.

But, in my opinion, the biggest challenge so far this winter has been transportation, even with the hours of service exemptions. The sheer distances traveled, coupled with lines at nearly every terminal, greatly reduced the capacity of each truck. Eventually, trucks will go where the supply is, but the further distances shorten their capability.

Because the cold weather wasn't just isolated to the Northeast, it was impossible to bring in carriers from outside our region to help out as we've done in previous years. They were too busy!

Ray Energy is delivering!

Our Ray Energy transports have been rolling around the clock, 7 days a week, to deliver timely supplies of propane from multiple supply points (pipe, rail, refinery, and marine) to our customers. We’ve also had tremendous help from common carriers and many independent carriers. We’ve purchased millions of gallons of extra propane supply to meet our customers’ increased propane requirements.

It isn’t easy. And we’re likely to face more challenges before this is over, and before we can all start to think of the spring meetings, when we’ll meet again and either laugh or cry about this winter. Laughter is better for the soul.

What’s happening with propane prices?

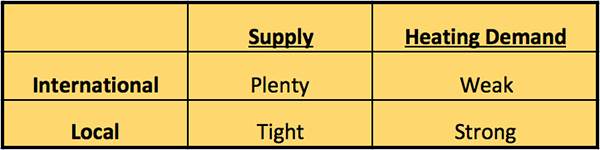

A customer from northern Vermont asked, “How can the price of propane at Mt. Belvieu, TX, drop when we have record cold temperatures, nearly a record inventory draw, and rapidly rising local prices for extra propane supply?”

Answer: Supply and demand.

- Mt. Belvieu, TX, propane prices are priced off international supply (plenty) and international heating demand (weak).

- Northeast spot propane prices are priced off the cost and availability of extra supply (tight) and local demand (strong).

Note: Crude and propane prices have been moving in opposite directions recently allowing propane to become a much more attrative petrochemical feedstock than Naptha. This should start to make a big difference in international propane demand.

What can I do differently?

Buy index supply contracts from Ray Energy. Contract 90% to 100% of your expected requirements including projected volume from new tank sets. The underlying base price may move (unless we convert it to a fixed price for you at some point), but your summer and winter differentials are set for the year. That's peace of mind!

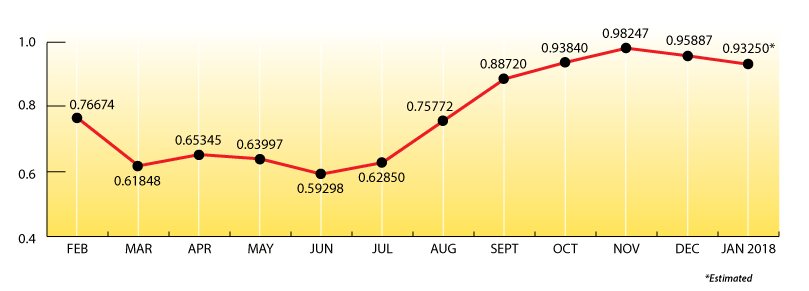

Here are the Mt. Belvieu monthly averages for the past 11 months with a projection for January 2018:

EIA weekly numbers:

US propane inventories for the week ending 1/12/18 had a fairly modest draw of 3.7 mmbbls. (58.00 mmbbls. total) or 19% behind last year.

Mt. Belvieu, TX, inventories drew down by only .93 mmbbls. to 44.1 mmbbls. and are 23% behind last year.

Conway, KS, inventories drew down by a more robust 1.85 mmbbls. to 19.4 mmbbls. total and are 13% behind last year.

Total US propane inventories are in the lower end of the five-year average range.

The Skinny:

I’ve been buying and selling propane for 30 years, and the current supply and transportation situation is as challenging as I’ve seen. Almost every retail and commercial account in the Northeast needs more propane than they contracted. That’s pretty scary.

We understand, unequivocally, that our customers need more propane now than they thought they would, and we’re working around the clock continuing to buy and deliver the extra propane supply you need.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our email newsletter here.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.