It Takes Two to Contango

Contango and backwardation.

Contango and backwardation.

With apologies to Pearl Bailey’s 1952 hit “Takes Two to Tango”, I thought it would be helpful this month to explain the difference between the terms “contango” and “backwardation”.

Simply put, when a market is in contango, each forward month is worth more than the current month. There is an incentive to store product, rather than discount it, since the future months are worth more. The premium to carry product forward is mostly reflective of costs associated with storage. Propane, natural gas, and crude oil are all in contango now. For example, from June thru January, the monthly “carry” for propane is about .005 cent per gallon.

Conversely, when a market is in backwardation, each forward month is worth less than the current month. There is little incentive to store unsold inventory, since the future months are worth less.

Backwardation is the underlying strategy behind OPEC’s decision to extend current production cuts. The idea is to place crude oil prices in such steep backwardation that US shale producers can’t lock-in returns on future investments, discouraging funding for future projects.

How does it work?

In theory, since propane prices are in contango, price and volatility are expected to rise as the calendar moves forward.

And OPEC would like for crude oil prices to be in backwardation, where price and volatility would be expected to fall as the calendar moves forward. But instead, the crude oil market is in contango and each forward month carries a slight premium to the preceding month.

Markets rarely meet expectations.

(At least, not at first).

The irony of any market that is either in contango or backwardation is that the current month often moves in the opposite of the expected direction, until the marketplace gives up and begins to reverse its positions, or the underlying fundamental conditions that originally created the premium or the discount become untenable. Then, we have the price spike or the price drop.

And here we’ll introduce one other market term: “capitulation” … which is a fancy term for surrender. Of course, we are not seeing panic selling in the crude oil market yet, but I think we are close to one of two things happening:

- Either crude oil prices will soon bounce off year-old support levels,

or - They will sell off.

What does this mean for propane prices?

For the past year, crude oil prices have been range-bound between $44 bbl. and $54 bbl. WTI is currently $45 bbl.

If crude oil prices find support above $44 bbl., and move back towards $54 bbl., then propane prices should start to naturally move back up about .10 cpg, towards .68 cpg.

On the other hand, if crude oil prices break below $44 bbl., it’s possible we could see capitulation in the market which could take crude oil prices back into the $30 to $40 bbl. range where they were two years ago. The propane equivalent would be about .45 cpg.

If the price of crude oil breaks below $44 bbl., and if propane as a percentage of crude continues to move back towards 50 percent, several things are likely to happen:

- Rig counts will begin to drop (we’ve seen 21 straight weekly increases), and US crude oil production will begin to decline.

- US propane exports will increase.

- The pace of weekly propane inventory builds will decrease.

None of these developments bode well for low propane prices this coming winter.

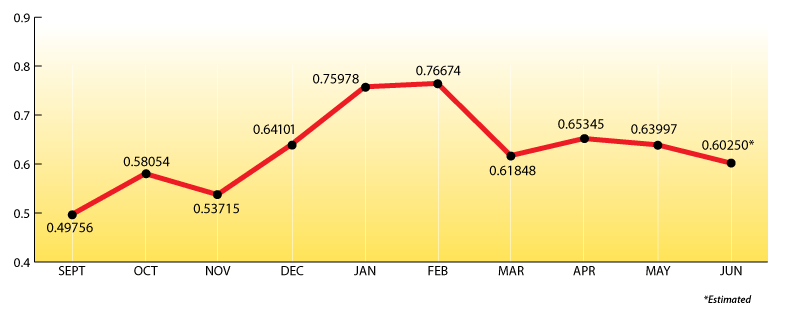

Here are the Mt. Belvieu monthly averages with a projection for June.

EIA Numbers for the Week (6/14/17)

Propane inventories built to 52.8 mmbbls. (32.6% behind last year’s level).

The Skinny:

Upside risk is now greater than downside opportunity.

Our recommendation: Layer in your pre-buy purchases with us, and cover your sales to your customers, by continuing to convert a portion of your index-priced supply contract with Ray Energy to a fixed-price contract.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our email newsletter here.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.