US Propane Supply and Pricing Update

What are the dangers and likely supply scenarios associated with our current inventory level?

What are the dangers and likely supply scenarios associated with our current inventory level?

I started buying pipeline supply from Mt. Belvieu, TX, and Conway, KS, around 1991, and railcar supply not long afterwards. I didn’t know anyone at first and so trips to Houston, Tulsa ,and Calgary were invaluable. I met a lot of very bright people and while most were kind enough to share their thoughts with me, a few became mentors. Instead of giving out easy answers, they asked questions. They made me think about what motivates companies, traders, and markets to behave in certain ways.

We are fortunate to have a lot of talented people in our industry and I thought it would be interesting to ask one of them about propane supply, pricing, and inventory levels. In future blogs, I’ll invite other industry experts to share their thoughts with us.

But first, let’s talk about one reason why inventory levels move.

In our last blog, “The Brent Goose," we talked about the importance of the price of propane as a percentage of the price of crude oil. In simple terms, the relationship is like an export throttle!

When propane trades well under 50% of the value of crude oil, the price of propane will be relatively low, and export demand will be relatively high. We would likely have a surplus of propane, or the perception is that we would soon have a surplus. We saw that in January 2016, and then again last summer, when the percentage dropped to 40% and the price of propane was in the .31 to .48 range.

When propane trades well over 50% of the value of crude oil, the price of propane will be relatively high, and export demand will be relatively low. We would likely have a shortage of propane, or the perception is that we would soon have a shortage. We saw that this past January and February when the percentage rose to 75% and the price of propane peaked near .90 cpg.

Which scenario do you think applies to us now?

Follow me here.

Propane stayed well under 50% of the value of crude oil all last summer, and our inventory level rose by 40 million barrels. We’re currently trading at about 55% of WTI. As a result, export demand is declining, export margins have been pinched to half where they were a year ago, and we’ve seen many Gulf Coast cargo cancellations.

Cancelled cargo volume, in my mind, becomes spot sales, or moves into underground storage.

On the production side, natural gas inventories trail last year by about 13%, but are still above the 5-year average. We’ve now seen 4 straight months of domestic oil rig count increases, up 125% from last year.

If these trends continue, aren’t we likely to see record monthly propane inventory builds this summer, possibly exceeding 50 million barrels?

Perhaps. But timing is everything … and the fact remains that we are at very low levels for May. And, there is no guarantee that the current trend will continue through October.

Discussion with JD Buss

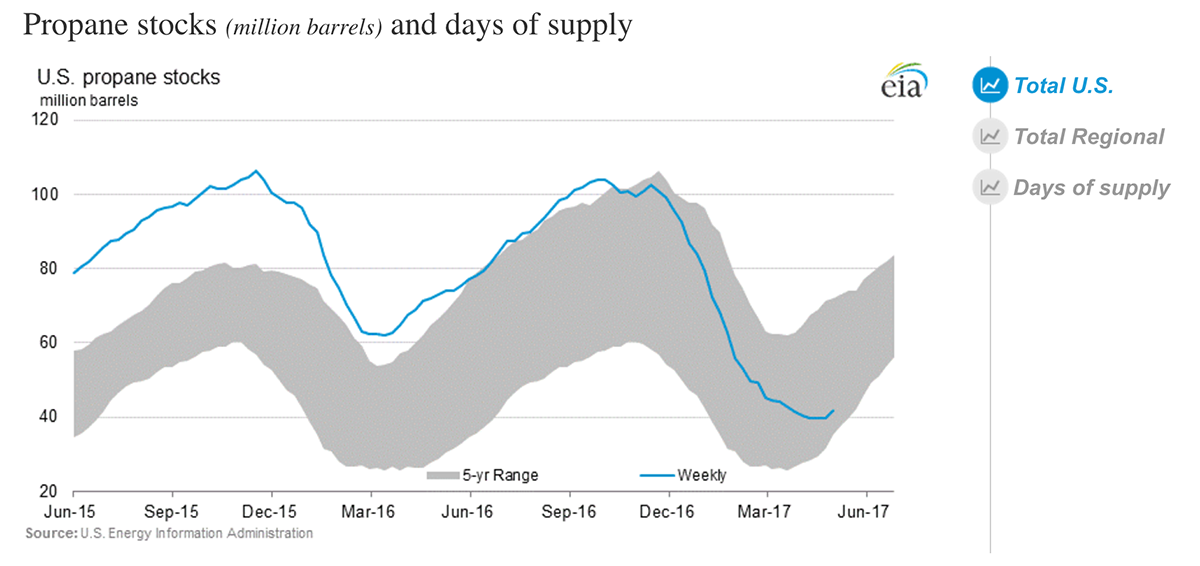

Heffron: US propane inventory stands at 42.2 mmbbls, roughly 45% behind last year, and near the bottom end of the average range for May. Can we build to adequate levels before the start of the heating season without the price of propane moving higher or the price of crude oil moving lower?

JD Buss: Inventory levels reaching higher levels always remains a possibility. That possibility, however, will likely come at a cost. Given the inventory drawdown for this past winter, we see a need to be in the 90 – 100 million bbl range as a ‘safety level’. To achieve that goal during this summer, there is a need to build 50+ million bbls over the next five months. Accomplishing this goal will require cancellations of cargoes which imply that international arbitrage spreads remain narrow. This could occur with domestic propane prices staying steady, moving higher, or failing to move as high as international prices. None of these price actions suggest a strong bearish market, but rather, a need for a stable to bullish market view.

JD Buss: Inventory levels reaching higher levels always remains a possibility. That possibility, however, will likely come at a cost. Given the inventory drawdown for this past winter, we see a need to be in the 90 – 100 million bbl range as a ‘safety level’. To achieve that goal during this summer, there is a need to build 50+ million bbls over the next five months. Accomplishing this goal will require cancellations of cargoes which imply that international arbitrage spreads remain narrow. This could occur with domestic propane prices staying steady, moving higher, or failing to move as high as international prices. None of these price actions suggest a strong bearish market, but rather, a need for a stable to bullish market view.

Heffron: Given the unprecedented draw-down of propane inventories from record-high levels since last November, and despite another mild winter, is a discussion of inventory levels even relevant anymore compared to production and export levels, days of supply?

JD Buss: A discussion of inventory levels continues to remain relevant but the relevance now shifts from the major hubs to a regional level. The growth of US export capacity has now shifted the need for storage from domestic sources to floating sources. It has also created a need for domestic US propane consumption to rely more heavily on regional storage to support the lack of steady demand usage throughout a year. Over the last several years, we’ve been a strong advocate to our client base to actively seek regional storage solutions.

Heffron: By now, everyone knows about the Mariner East 2 pipeline, which will run from the Marcellus and Utica shale regions of western PA, WV, and OH, to Sunoco Logistics' Marcus Hook, PA, export facility. The pipeline is scheduled for completion in November. What do you see as the obvious, and maybe less obvious, impacts of the pipeline on the Northeast propane marketer?

JD Buss: An obvious impact of the Mariner East 2 (and 2x) pipeline would be origin propane in Western PA being priced at pipeline economics rather than rail or truck economics. If the cost to move propane from Western to Eastern PA equals “XX”, then a potential cost for product at point of origin will be Belvieu less “XX”. Given the efficiency of pipeline transportation over rail and truck, this “XX” cost will be lower, thus creating a higher purchase cost at point of origin. Another impact may be a greater reliance on pipeline gas as opposed to rail gas within that region. This in no means implies that rail gas will disappear, just that options from the pipeline may regain some importance and could add some creativity to a retailer’s supply portfolio. Lastly, given the size of the Mariner East 2 and 2x pipelines, there could be increased production in the coming years. That will likely provide more overall supply for both the export market and the domestic market.

Heffron: What are some of the warning signs that we could look for in terms of potential supply issues in the Northeast, the “canary in the coalmine”? For example, it’s been suggested that lengthy truck lines at a Kentucky refinery could indicate brewing trouble. Are there warning signs that come to your mind?

JD Buss: One of the time-honored signals of supply “issues” (either price or availability) for the Mid-Atlantic to Northeast regions has been traveling to North Carolina to pull off the last terminal on the Dixie pipeline. This still may occur and still should be a good signal. I would also advise everyone to watch the lineups at Marcus Hook. The implication from the Mariner East 2 and 2x lines is that exports will flow regardless. Export movement, both increasing and decreasing, definitely relates to price. If the US retail community is willing to pay more for product than the export market, then one large available resource is Marcus Hook.

Heffron: Thank you very much JD.

JD Buss works at Twin Feathers Consulting. He worked previously at Koch Industries and Enron.

You can reach JD at 913-851-7575 or jd@twinfeathers.com.

The Skinny:

If propane prices stay high, relative to crude, it’s likely that the export window will remain largely closed, and we should reach 90 to 100 million barrels of inventory by late October. Under this scenario, prices may drift up and down, but should stay fairly stable.

On the other hand, if propane prices move much lower, relative to crude, the export window will likely open again, and we may only see modest monthly builds this summer. Under this scenario, the conditions would be present for a near certain price spike, probably occurring within the next three months.

Prices are at a fair level now. For peace of mind, or if you intend to offer fixed pricing as an option to your customers, you should consider converting some of your index-priced volume with us over to a fixed price.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our email newsletter here.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.