Winter Forecast for Propane Supply, Demand and Pricing

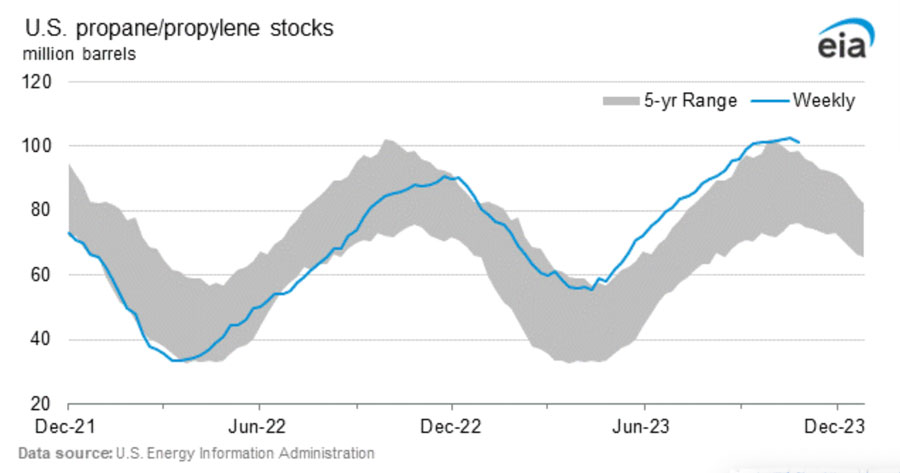

U.S. propane inventory levels this year are the 2nd highest on record, largely because the build season started from a higher level. The EIA’s low-fuel gauge read “33.3 million barrels to empty” (Spring 2022) and “55.4 million barrels to empty” (Spring 2023). The higher starting point has been a major reason for propane’s historically low value to crude.

What’s better than an “18% Off” propane clearance sale? A “25% 0ff” sale!

Since 2010, the average price of propane as a percentage of crude has been near 50%. But it’s been in the low 30% range for months now. This “18% off” clearance sale has been good news for propane retailers and commercial accounts as you’ve been saving nearly $.35 per gallon!

It’s not because the export market has been asleep at the helm. On the contrary, propane exports have been near 84 million gallons per day, up 24% versus last year. Many petrochemical companies, including giants like Formosa Plastics in Taiwan, started shifting some of their feedstock (typically about 8% to 18%) from naphtha to LPG earlier this year when the discount approached $.09 per gallon.

So the clearance sale, which could get to “25% off” this winter, did what it’s supposed to do, move propane. But all of that changed on November 1.

“El Nino” and “El Seco.” The dry one.

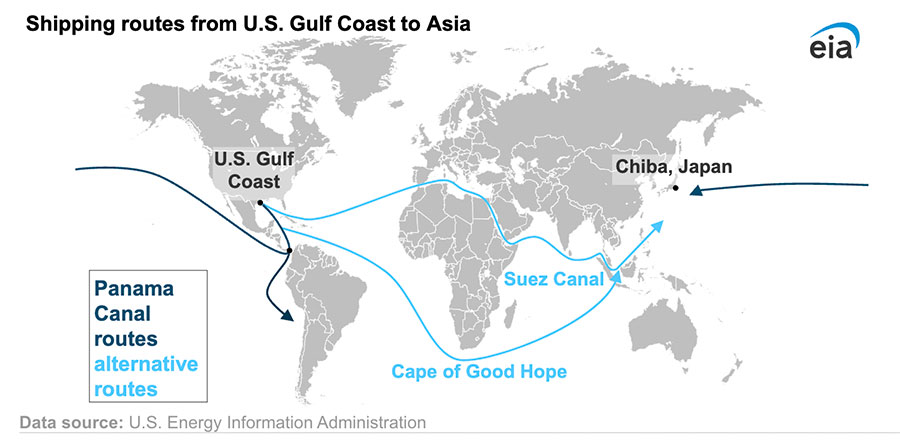

The Panama Canal has experienced one of the worst droughts since 1950. And the water level at Gatun Lake (a freshwater lake that forms a major part of the Canal) is at its lowest level in 28 years.

From a Fire Hose to a Garden Hose.

Citing historically low water levels, the Panama Canal Authority threw marine engines into reverse on November 1, 2023, by announcing progressively restrictive transit reductions for at least the next 4 months. The new restrictions, which include the Neo-Panamax locks for larger ships like VLGCs, cut booking slots in November to 25 ships per day. For comparison, the daily average in 2022 was about 38 ships per day. By February the number of vessels allowed to transit the canal will be 18 ships per day “until further notice”.

The reason the reductions are scheduled to be progressively greater after November is because December marks the end of Panama’s rainy season and the beginning of its dry season.

Given that there will likely be 50% fewer vessels transiting the canal this winter, U.S. export volumes could be reduced from a fire hose delivery of LPG to a garden hose.

Asia is the premier market.

The reason why these canal restrictions are especially challenging for U.S. exports is that 3 of the top 4 destinations (Japan, China, South Korea) are in Asia. They account for more than 50% of all exports. Add Indonesia, Singapore, and Chile into the mix and you can begin to see the Canal’s importance to Gulf Coast and East Coast exports.

In a recent Seatrade Maritime interview, Ricaurte Morales, the Panama Canal Administrator, corroborated this by mentioning that 35% of the 14,000 transits per year are energy products such as LNG or LPG and “two-thirds of that either comes or goes through the United States.”

Simon Says.

Simon Hill is a British expert on the waterborne and international LPG markets and he shared some thoughts with us recently. (The parenthesis are mine).

“My feeling is that there simply aren’t enough ships. The talk is that we will see 30 to 35 less VLGCs passing through Panama, zero larger neo (Neo-Panamax canal) VLGCs in January. Add 20% to 25% more time going via Suez, COGH (Cape of Good Hope), or even the Magellan Straits and that’s the same as a 10% to 15% reduction in capacity.”

“Inventory will struggle as any draws are likely to be reduced, MB (Mt. Belvieu) prices will slip (to) 25% WTI but the ARB (price relationship between import/export locations) will not do its job as ships are finite.”

“But Asia is underperforming. PDH margins are negative (propane dehydrogenation plants make the building blocks for the plastics industry) and the Chinese economy is lackluster … so if the weather is mild you have to question how much the delays getting cargo will matter.”

Weekly Inventory Numbers

Due largely to a sizeable gain in PADD 4 and PADD 5 (Rocky Mountains and West Coast) stocks, total U.S. propane inventories showed a surprising build of 1.3 mmbbls. for the week ending November 10, 2023. Industry expectations were for a modest draw. This brings national inventory levels to 99.7 mmbbls., about 13% above last year and 17% above the 5-year average.

PADD 1 (East Coast) inventories showed a small build of .4 mmbbls. They stand at 9.8 mmbbls. about 7% above last year.

PADD 2 (Midwest/Conway) inventories had a negligible build of .1 mmbbls. They stand at 26.9 mmbbls., nearly 5% higher than last year.

PADD 3 (Gulf Coast/Belvieu) inventories recorded a minimal draw of .3 mmbbls. They stand at 56.1 mmbbls., roughly 16% ahead of last year.

The Skinny

It’s no secret that there’s plenty of propane available for this winter. But most of the supply in storage isn’t next door. So whenever you need something extra this winter, please let us know as early as possible.

And let's remember the old proverb: "A bird in the hand is worth two in the bush." Propane’s absolute value, and value relative to crude, is at a very low price level making this a good time to “lock-in & layer-in” a portion of next season’s propane supply with us. Please let us know if you’re interested.

We’ll always be there for you.

From our Ray Energy family to yours, Happy Thanksgiving!

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2023 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.