Changes in U.S. and Northeast Propane Demand

My wife and I often talk about taking a long weekend in October and going away somewhere before things get crazy in our industry. But then the first frost arrives and the maple leaves start to change, and we acknowledge to each other that there may be no finer place on earth in October than right here in New Hampshire.

Two pieces of good news (one now, one later):

The first piece of good news is that we continue to have record-high inventory levels of propane on hand, about 4% ahead of last year’s record-setting level. (The table below is in million barrels).

| 2016 | 2015 | 2014 | |

| US | 104.0 | 100.0 | 80.6 |

| Midwest | 29.1 | 27.5 | 28.0 |

| Gulf Coast | 63.1 | 62.0 | 43.2 |

Where is all the propane coming from?

The propane production split between the two “parents” of propane, natural gas processing plants and refineries, was about 60/40 not too many years ago. Now it’s more like 80/20. The biggest increase in propane production is coming from the Marcellus Shale region.

Drilling activity has bounced back slightly in the past two months (96 natural gas rigs - up 15 rigs since August). Recent increases in crude and natural gas rig counts correspond to a $9.00 bbl. increase in crude and $0.40 per mcf increase in natural gas prices ($3.20 versus $2.80), but the rig count is still down 50% from last year, and 94% from the 2008 peak (1,600 rigs). The natural gas one-year chart looks bullish to me, with higher lows during the recent consolidation phase, which often leads to break-outs in the trending direction.

U.S. and Northeast Propane Demand

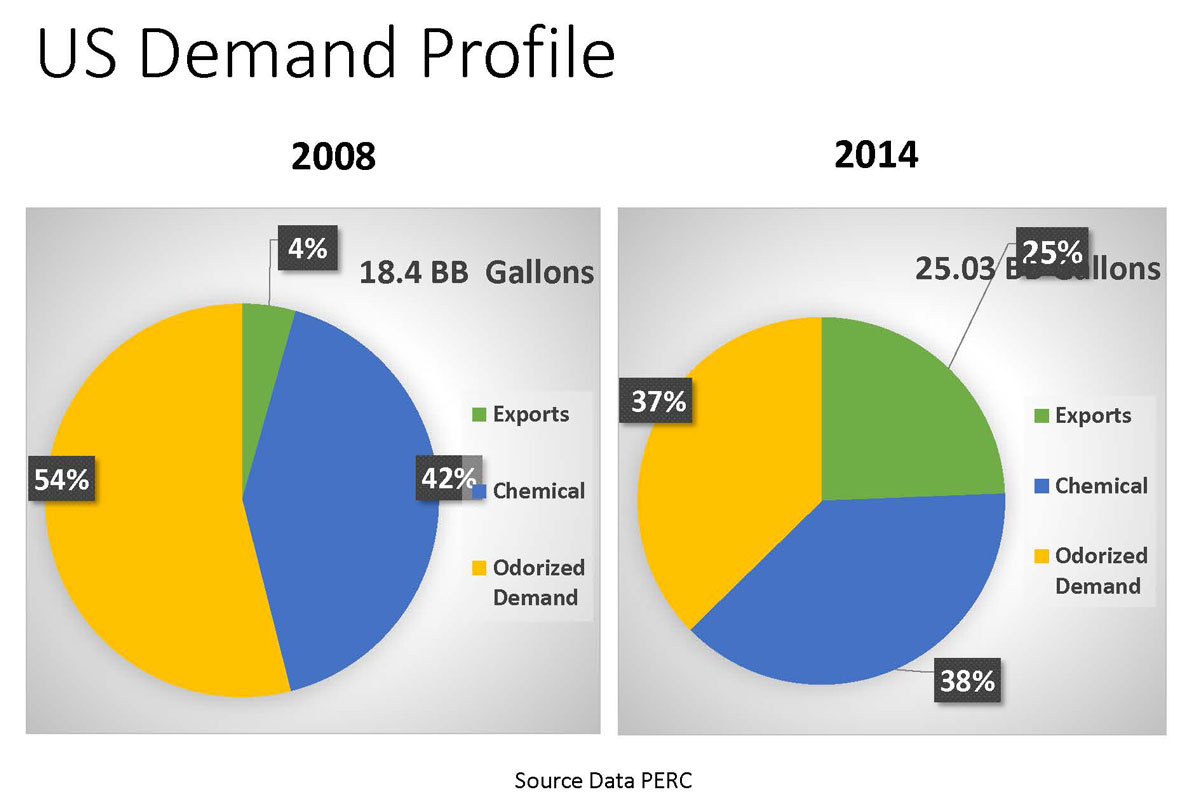

The pie chart below, based on PERC data, shows how U.S. and Northeast propane demand has been changing since 2008. On the left side, odorized propane represents the greatest demand, followed by the petrochemical industry, and exports as a very small fraction. In 2014, the pie chart changes to the petrochemical industry first, odorized propane second, and exports still third, but almost equal.

In just the past two years, however, daily exports of propane have jumped from 17 million gallons/day to 30 million gallons/day (or higher) and a new demand chart would show exports now commanding the largest slice of the pie.

Speaking of the petrochemical industry, a customer in the Adirondacks asked me to explain how propane turns into plastic. It's funny that propane is often used as the feedstock to make our credit cards. So here goes:

Natural gas liquids, such as propane, are the primary feedstocks for petrochemical crackers which use intense heat to “crack” or break apart the hydrocarbon molecules. After being cooled down, a chemical compound/catalyst is then introduced (a process called polymerization) which makes the small plastic pellets that become the building blocks for the manufacture of plastic products. Amazingly, the petrochemical industry often consumes more propane in a year than all of our U.S. retail and commercial gallons combined.

I thought you had more good news for us?

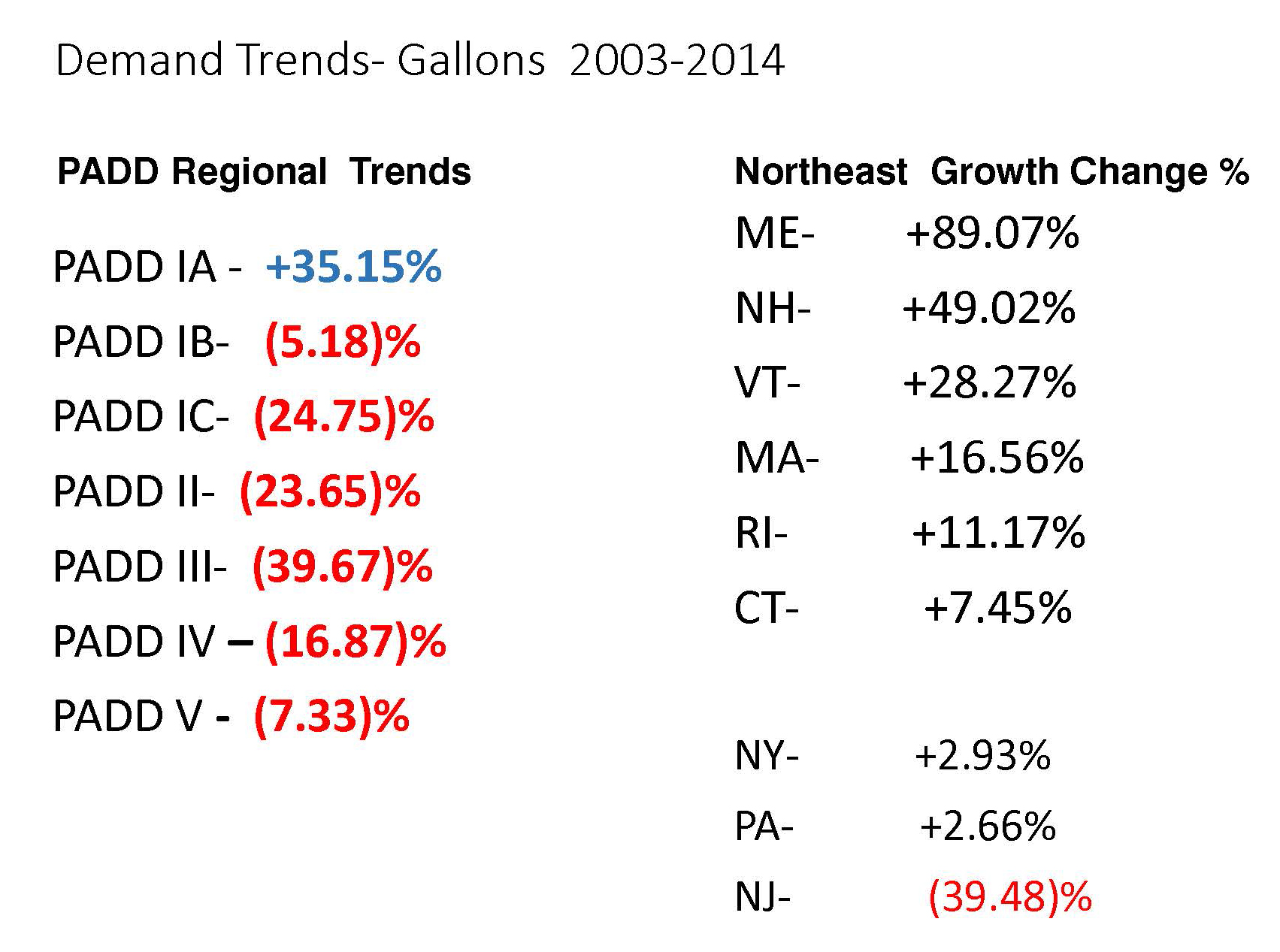

The second piece of good news is that while the overall growth change for the U.S. in terms of odorized propane sales is down, it is up roughly 30% if you combine the East Coast (PADD 1A, which is New England), with the Central Atlantic (PADD 1B, which includes New York), and exclude New Jersey.

It’s all about balance.

High propane production levels have a symbiotic relationship with export levels, since high production levels require high export levels for their survival, and vice versa. For example, look at Canada -- they’ve been a net exporter for years. And now the U.S. is in the same boat, producing much more propane than we can consume, and so we are exporting more propane than ever before. It’s a balancing act, because we need to have a low enough price to encourage exports, but not so low that we lose domestic production.

For now, it all sounds great. After all, we have the lowest prices of propane in the world, we have lots of inventory on hand, and here in the Northeast, we market propane in the only region of the country with growing demand.

So what is the potential danger?

The potential threat to stable pricing is that production levels continue to decline, while export capacity and export demand continues to expand.

The difficult questions to answer are:

- How much propane will the world need from us this winter, next year, and in five years?

- What is the world willing to pay?

I know it seems odd to talk about this when we have so much inventory on hand. After all, the upward swing in inventory level has never been greater, but we have yet to experience a dizzying drop.

The timing of a potential crises may be a better question for an economist, since the canary in the coal mine will likely be a spike in China’s gross domestic product (18% of the world economy) at a time when international propane production falls well short of international demand. As an indication of China’s propane appetite, the largest LPG importer in east China has signed multi-year supply contracts with companies like Targa and Enterprise for multiple propane cargo ships to depart from the Gulf Coast from now through 2020.

The concern, at some point, will be when the world community tries to outbid the U.S. for our abundant propane supply, regardless of price. I suppose turnabout is fair play since that’s exactly what the U.S. has done for years to the world community.

But just like the dilemma facing OPEC (where production cuts and higher crude prices will only encourage more U.S. drilling), if the price of natural gas were to move sharply higher … say back towards the 2014 high of $5.00 per mcf … we would see a renaissance-like surge in U.S. drilling, rig counts, and higher natural gas liquids production.

So, any price spike, if and when it occurs, should be relatively short-lived. Which I guess is another way of saying that although the stakes are high, and we are likely to see some wild inventory swings for the foreseeable future, the U.S. is now as much in control of the global balance of hydrocarbon supply as any nation on earth.

What should I do?

To paraphrase Bette Davis: “Buckle up, it’s going to be a bumpy ride.”

But don’t worry until I worry. We have plenty of propane inventory on hand, and prices should continue to stay fairly stable for the next few months, unless we see a breakout in crude and/or natural gas prices (possible). If we see any big changes coming, we’ll tell you beforehand, with suggested action items to protect you and your customers.

For now, we recommend that you have all of your fixed-price sales covered, and enough winter supply contracted to meet the past three-year average.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our email newsletter here.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.