Ferrari Red

Deja Vu.

We’re facing similar market conditions today as we did five years ago.

In the January, 2019, blog we wrote that we were entering a period of low propane prices relative to the price of crude oil. No one knows how long it will last but it’s here and it’s a good thing. It’s good for you and your customers. It’s good for budgets and receivables. Most importantly, it’s good for driving new growth and increasing propane’s market share.

The same problem then, as now, was that export capacity was straining to keep up with record propane production.

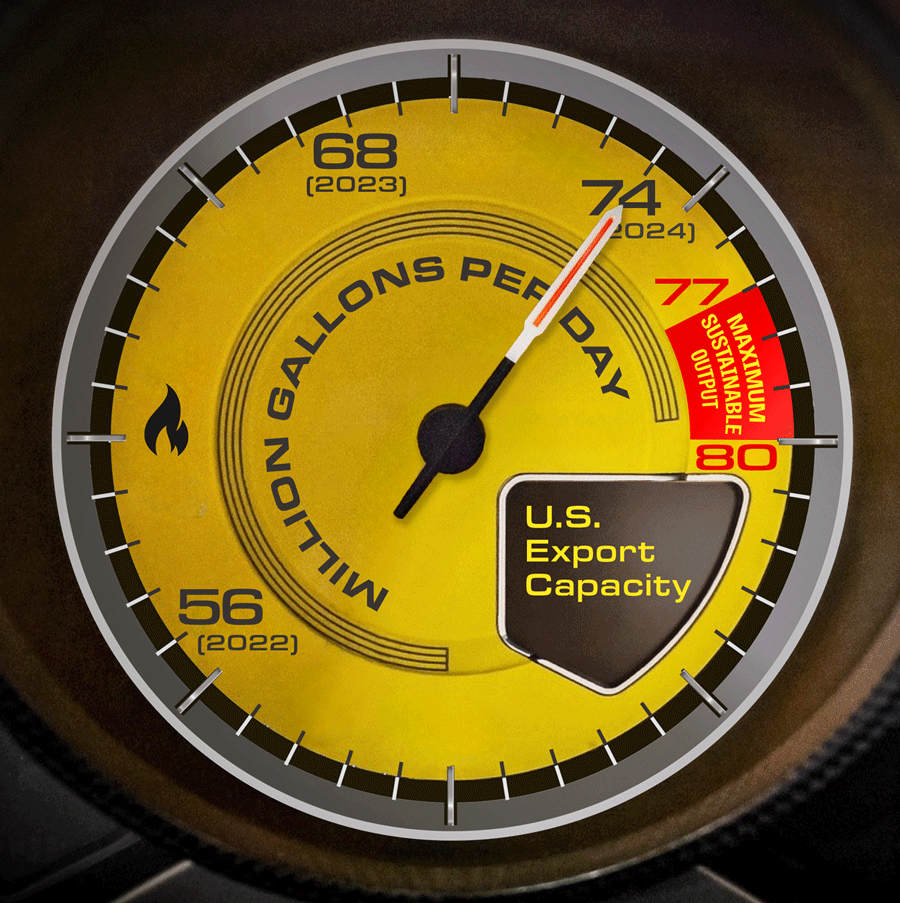

If the U.S. LPG export terminals were a Ferrari, the needle on the tachometer (measures the working speed of an engine) would be near the red section for maximum sustained output.

We created a Propane Export Levels Gauge below to look like a tachometer but replaced the standard “rpm x 1000” measurement with “million gallons per day.” You can see that the running-average needle is near 74 for 2024 with the running-average “redline section” from 77 to 80.

Propane Export Levels.

A Good Value Doesn't Mean Lower Prices.

It’s very true that export capacity constraints can lead to oversupply issues. As it turned out in 2019, propane prices didn’t move much higher for two years. But we can’t draw a parallel to 2024 because of the pandemic in 2020. Demand destruction is not the case now, more like the opposite. The similarity to 2019 is that waterfront dock expansions in the Gulf Coast and Marcus Hook aren’t scheduled for completion for another year or two, so propane should continue to be a good value.

A good value doesn’t mean that propane prices will move much lower. Why?

Current prices are already near last year’s lowest prices. They’re also at 36% (take C3 x 42 divided by WTI) relative to the value of WTI crude oil. So the “15% off” clearance sale sign is already hanging in the window.

For some perspective, let’s look at this in an unusual way: Suppose that today’s crude price reflected propane’s historical percentage of crude. We’d be looking at $58.00 bbl. crude today, not $78.00.

What Happens Next?

The three cures for oversupply and export capacity constraints are pretty simple: sell more, make less, or store more.

- Sell more at home: Producers won’t get much help from the retail propane industry now (this is where greater autogas demand could help) and propane is already in a race to the bottom with butane to be the domestic petrochemical industry’s preferred feedstock.

- Make less: That’s only really possible if there are production cuts in the “wet” natural gas wells, those that are richer in natural gas liquids such as propane.

- Store more: You have to pick cure #3 for the balance of summer because Mt. Belvieu is the world’s largest underground salt-cavern storage and current inventory levels are about 10% behind last year. But the market needs to be in a much healthier contango to encourage folks to store now and sell later. So, why isn’t the market worth more than $.002 per gallon per month from now through September? I don’t think sellers trust overly discounting the front months now. There’s no panic.

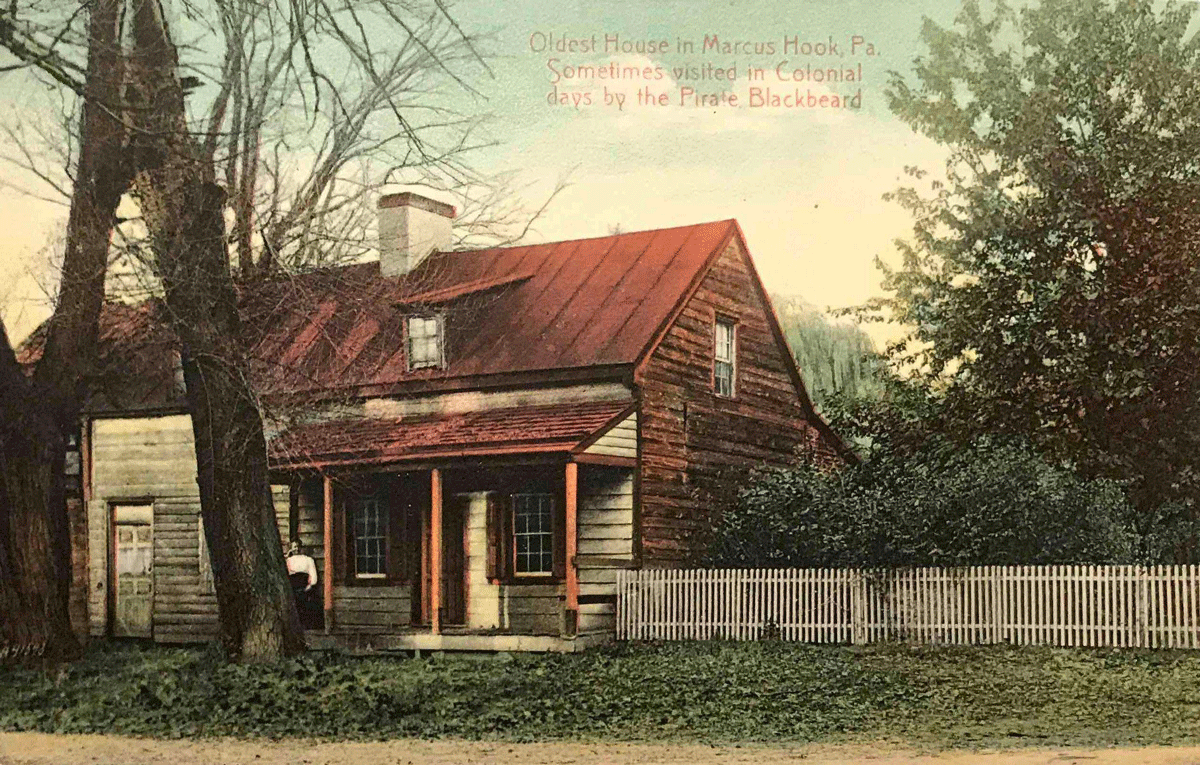

Marcus Hook, PA.

According to the Marcus Hook Preservation Society, this maritime town was once “a haven for pirates when pirates plagued the lower Delaware River” over 300 years ago. Supposedly, the pirates (including Blackbeard) often partied at the Plank House on Discord Lane, now 2nd Street.

Energy Transfer’s export docks don’t see many pirate ships these days but they do see plenty of Very Large Gas Carriers (VLGC). The East Coast now accounts for

The Skinny

Once again, it seems that we are entering a period of low propane prices relative to the price of crude oil. No one knows how long it will last, but it’s here and it’s a good thing! It’s good for you and your customers. It’s good for budgets and receivables. Most importantly, it’s good for driving new growth and increasing propane’s market share.

In a world of change and uncertainty, one thing is certain. Ray Energy will be with you, supporting your efforts, every step of the way!

Get Stephen's insights on propane delivered to your inbox every month. Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2024 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.