Heating Oil Supply, Skating on Thin Ice

.jpg)

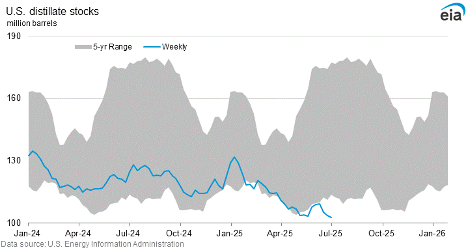

U.S. distillate fuel oil inventories are about 23% below the 5 year average (chart below) and East Coast stocks are about 28% behind last year’s level, so it seems like a good time to talk about middle distillates which include diesel, jet fuel and home heating oils.

In fact, the last time U.S. distillate inventory levels were lower than they are now (but only by a whisker) was in 2005!

Gasoline/Heating Oil Chart

- The 10 year chart below shows the spread between prompt month gasoline and heating oil (dark blue line).

- It’s unusual for NYMEX heating oil/diesel prices to be $.25/gallon higher than NYMEX gasoline prices (light blue line) during the summer. The average spread is typically flat.

The Bottleneck

The bottleneck is that limited domestic refining capacity can’t keep up with crude oil output or strong demand for refined products. It’s not for lack of trying. Refinery runs have been in the 94-95% output range which is near maximum capacity.

Many U.S. refineries have closed due to high operating costs, carbon taxes and other regulations, or they’ve been repurposed (brownfield investments transform existing refinery sites into biofuels or renewable fuels facilities) despite rising demand for traditional oil products.

Where the industry is skating on thin ice is that there’s little margin for error in terms of unplanned maintenance or an unexpected shutdown.

Global Refinery Growth

The problem isn’t that global refinery construction has been shrinking. Worldwide, there are roughly 25 more refineries operating today than 10 years ago. But most of the new refineries aren’t here, or in western Europe.

They’re mostly in the Eastern Hemisphere with the greatest growth in Africa, Asia and the Middle East.

What this Means

Let’s remember, it was only 3 years ago that we saw headlines like this: “Experts Raise Concerns of Heating Oil Rationing in New England Amid Supply Shortage.”

So, the short-term concern is that heating oil supply could get tight and become more expensive this winter, leading some retailers to buy “just in time” inventory. The long-term concern is that the U.S. will become increasingly dependent on foreign countries to meet our demand for petroleum products, making us less energy secure.

The Good News for Propane

The good news for propane is that it is mostly produced at natural gas processing plants. And LPG export levels seem to set new records every year, largely because production levels of natural gas liquids, such as propane, have been increasing and there isn’t enough domestic demand to consume all of the propane made in America.

The Skinny

Middle distillate supply tightness all boils down to supply and demand. Supply that’s limited by refining capacity, and strong demand for oil products.

Granted, it’s too soon to know if there will be a heating oil supply shortage this winter. But if there is tightness and rising prices it could accelerate the fuel switching in the Northeast and Mid-Atlantic from heating oil to propane that has already been underway.

The bottom line is that retail propane companies may need more propane than what they originally contracted for 2025-2026. So, please reach out to your Ray Energy marketing representative with what you’re looking for. We’ll be there for you!

Get Stephen's insights on propane delivered to your inbox every month. Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2025 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.