Is There a Critical Propane Supply Situation?

Fewer wells means less propane.

Fewer wells means less propane.

It may be obvious that energy companies don’t drill for propane, but it’s a stubborn fact that is at the heart of the current propane supply debate.

Fewer wells means less propane.

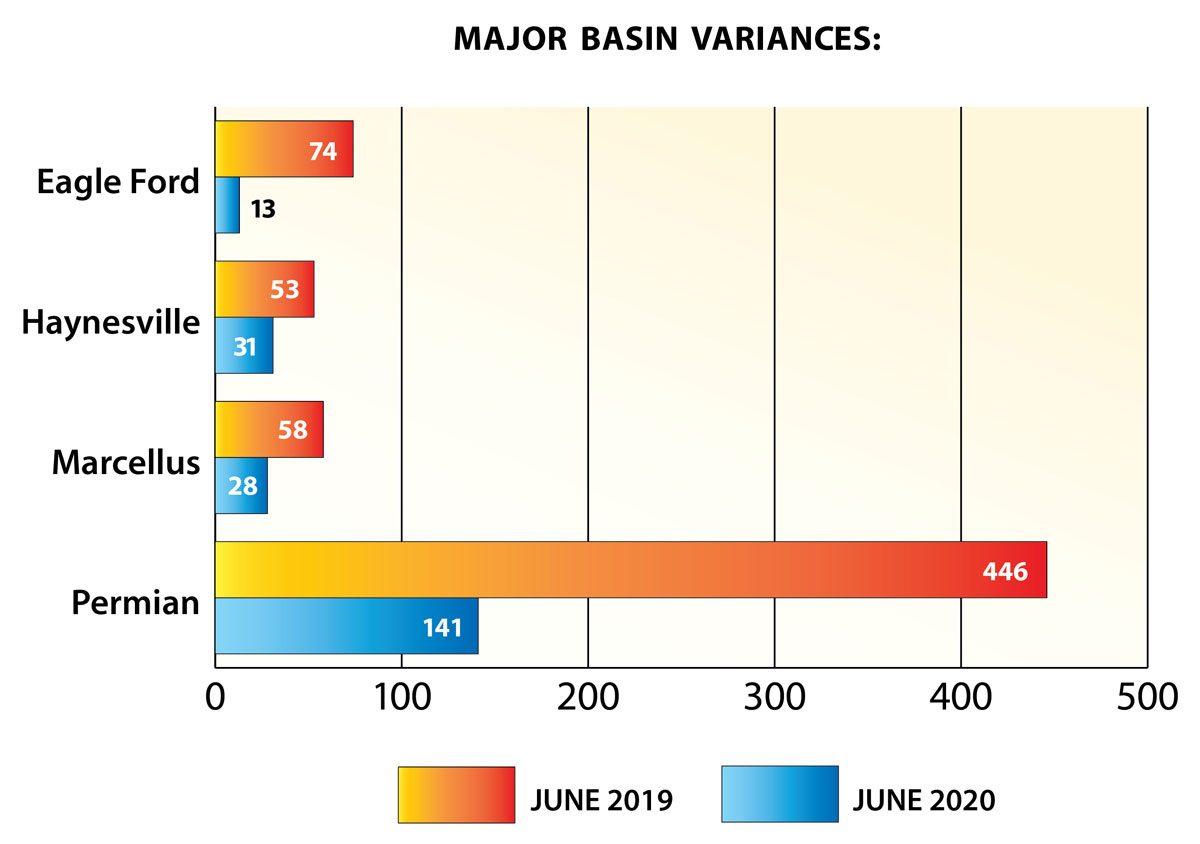

But another critical aspect of diminished shale production is that the location of reduced propane production takes on greater significance. This is especially true for high-producing shale plays that are far from Texas, like the Marcellus.

So it’s easy to read the tea leaves … even if they are covered in oil. And there’s no denying the groundswell of concern from industry experts regarding the looming potential for regional propane supply shortages this winter.

The rationale behind possible shortages.

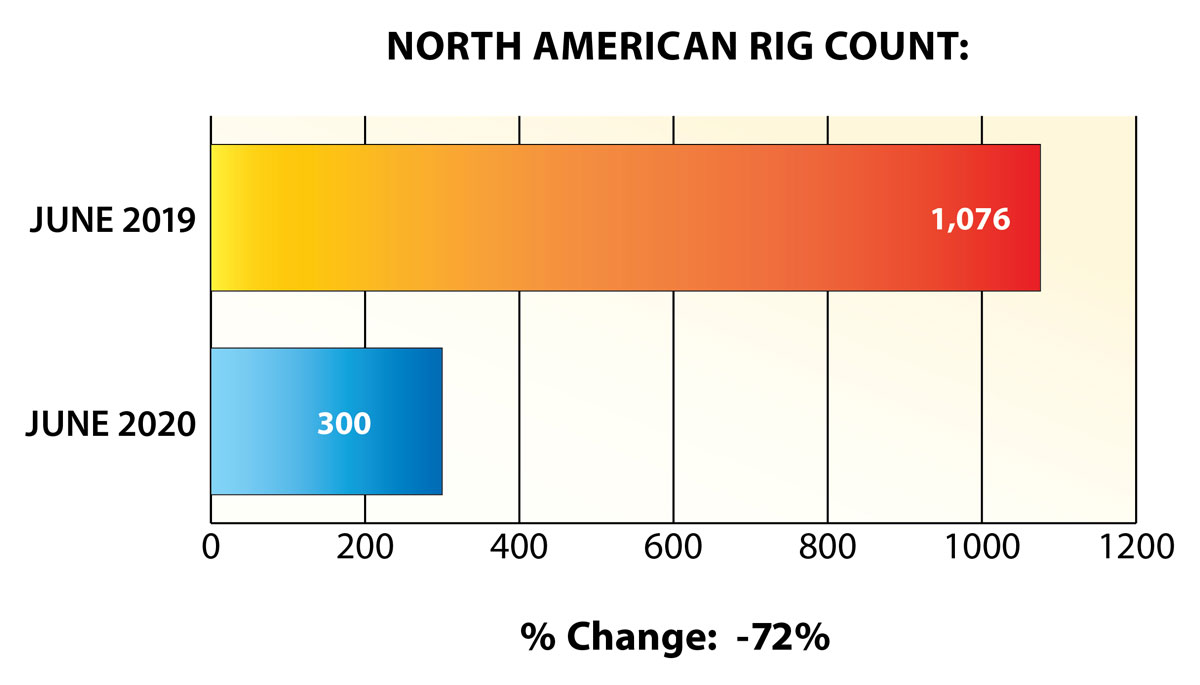

Most of our U.S. propane supply comes from “wet” natural gas wells that are rich in natural gas liquids and from “associated gas” (the natural gas contribution from wells that are primarily oil wells) which can also be rich in natural gas liquids. The alarming thing is that the total rig count of working wells (down 72 percent since last year) has dropped to the lowest level in over a decade.

Does the U.S. have a propane supply problem?

Domestic production of propane is more than enough to meet our retail and commercial requirements. But just as with real estate, location is everything. So the U.S. doesn’t have a propane supply problem, it has a location problem.

Price will always move the needle.

We can’t change propane production. But demand from the propane industry can influence the location of where propane goes (Netherwood, NY, or the Netherlands?), who’s using it (Basel Oil & Propane or LyondellBasel?), and how much they’re using.

Price will always move the needle and the petrochemical sector is price sensitive. Their feedstock cost analysis includes numerous calculations before polypropylene can become a toothpaste cap and hinge, and the cost of the feedstock is one of them. They have no problem using less propane if it’s possible and profitable to switch to another feedstock such as naphtha or ethane.

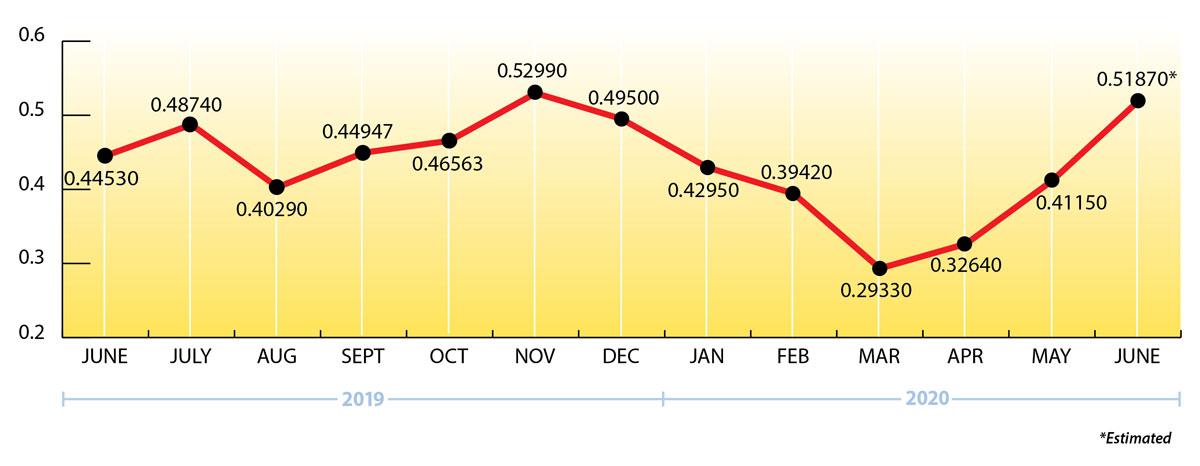

For about a month now, lower demand coupled with higher prices for propane and a higher propane percentage to crude value (57 percent) has reduced U.S. propane exports by about 30 percent and lowered propane demand from U.S. petrochemical plants.

That’s good news. But in order to reach the peak inventory levels of November 2015 and September 2016, we would need an additional 1.47 billion gallons of propane added into storage.

COVID-19 and best advice.

I think the coronavirus forced many retailers into an uncomfortable position this spring.

Uncertainty surrounding summer demand made monthly forecasts and traditional summer/winter scheduling ratios very difficult.

Preventing or mitigating the impact of a potential regional propane supply shortage this winter will involve planning ahead because greater timing is required.

Storm preparation should include an action plan and a good warning system. You can prepare for the worst by following this suggestion:

Carefully review your supply and demand forecast. If you believe that you may be under-contracted, take action now and commit to more summer and winter supply.

Why is “now” important?

Because timing and location are more important factors than usual. Waiting may mean reacting in December rather than preparing in June. The additional winter supply that’s available to be purchased now may be on a ship to Japan, made into a plastic toothpaste cap, or still in Texas, otherwise.

Your best “warning system.”

A trusted advisor and an experienced team is your best “warning system.” Knowledgeable suppliers understand what’s likely to happen before it happens and they know how to prepare for the unexpected because they’ve done it before.

What’s happening with propane prices?

Crude oil and propane prices have probably moved too far, too fast, since the end of March (propane) and the beginning of May (crude), but they don't seem to be taking much of a breather.

Propane Price Chart

Weekly Inventory Numbers

Thanks largely to robust builds in the East Coast (PADD 1) and Central-Atlantic (PADD 1B), total U.S. propane inventories exceeded industry expectations showing a build of 2.685 mmbbls. for the week ending June 12, 2020. That brings national inventory levels to 68.967 mmbbls., about even with last year and approximately 6 percent ahead of the 5-year average.

PADD 2 (Midwest/Conway) inventories showed a small build of .408 mmbbls. They currently stand at 16.356 mmbbls., roughly 15 percent behind last year.

PADD 3 (Gulf Coast/Belvieu) inventories showed a modest build of .664 mmbbls. They currently stand at 42.392 mmbbls., about 2 percent behind last year.

The Skinny

Ray Energy recognized early on that the propane industry may face unusual supply challenges this year. In anticipation of these challenges, we strengthened our position by incorporating new sources of supply, transportation, and distribution points into our existing supply portfolio. We also added more regional “wet gallon” storage positions into the mix.

The core foundation of our strategic supply philosophy has always been to maintain diversification on many different levels. This “new and improved” combination of assets and resources provides us with even greater flexibility as we prepare to meet your upcoming propane requirements.

So, whether it’s for this month … this summer … or this coming winter, please let us know if you need more propane.

Ray Energy can help.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2020 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.