It Don't Mean a Thing If It Ain't Got That Swing!

A lot has been made recently of higher propane exports and declining propane inventories in September. To understand what’s happening, let’s look at a few important relationships that have either swung wider in one direction or swung in a different direction since this summer:

- The first thing we need to consider is the sharp backwardation that’s in the marketplace. The market was in contango this summer (worth more each forward month), but has now swung into sharp backwardation (worth less each forward month). That means the folks that make our propane have little incentive to store propane for future sales. So, it’s a “sell now” mentality, especially true for propane exports. Backwardation in a marketplace discourages inventory building.

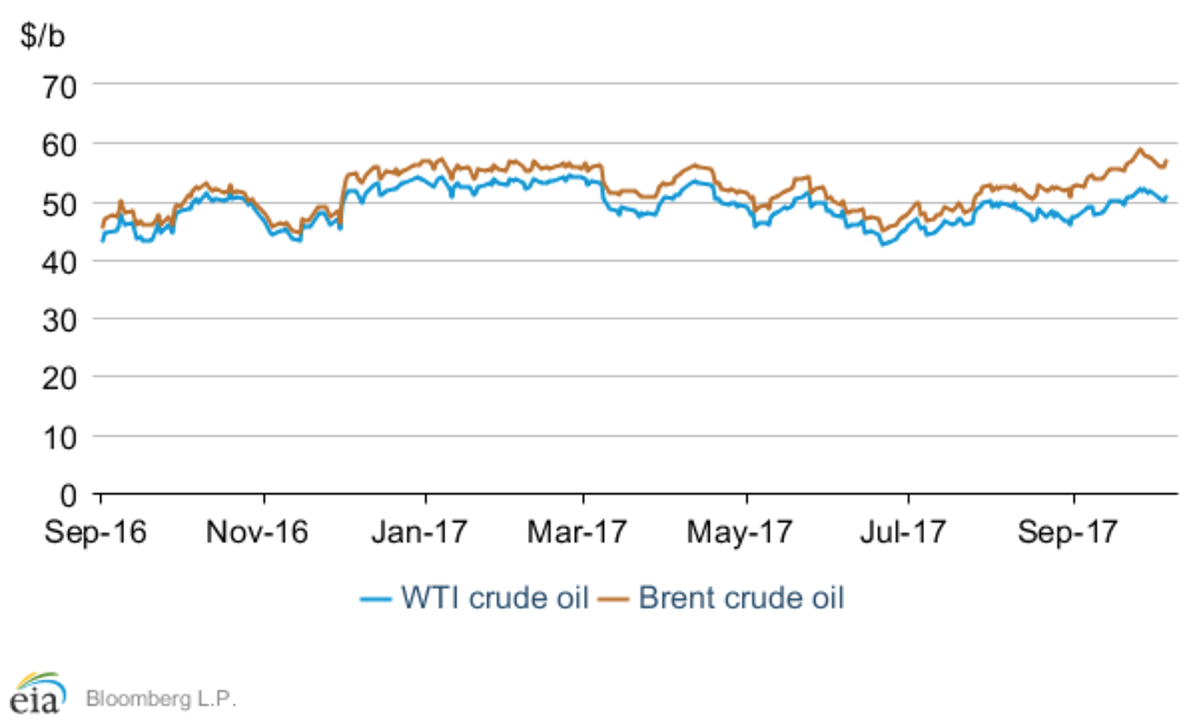

- The second thing to consider is the WTI/Brent spread which has swung wider recently. As the spread between WTI (US) and Brent (International) widens, those products refined from WTI (including propane) will have more export appeal. Freight differences matter less when the underlying cost of a product has a greater price advantage.

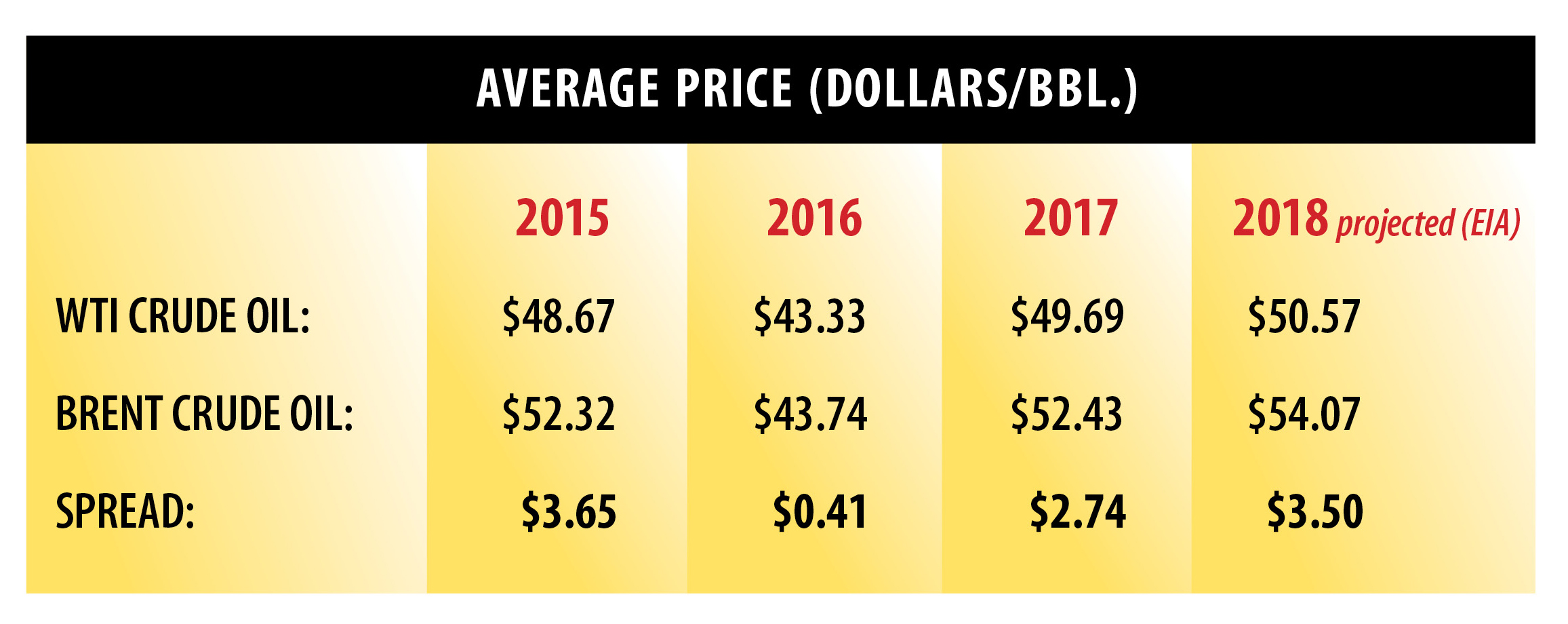

The recent historical spread between WTI and Brent is in the $3.00 bbl. range. Here’s a look at the past three years and a projection for 2018:

But, look what happened shortly after Hurricane Harvey when Gulf Coast refinery production was shut down for weeks:

Crude Oil Front-Month Futures Prices:

Notice the spread widening in September. In fact, the WTI/Brent spread for the month of September swung all the way out to $6.40 per barrel and is still trading in that $6.00 range!

Conclusion:

Unfortunately, the circumstances that came together in September to drive propane prices up and inventories down have not changed substantially.

EIA numbers for the week:

- Propane inventories fell by 0.1 mmbbls. (78.83 US total).

- Gulf coast inventories dropped by .851 mmbbls. (41.42); Midwest inventories rose by .403 mmbbls. (27.27).

- Total U.S. propane inventories are 24% behind last year, in the lower half of the five-year average range.

- Exports stay robust, due largely to the recent swing from a market in contango (worth more each forward month) to strong backwardation (worth less each forward month). A "sell now" mentality exists.

What’s happening with propane prices?

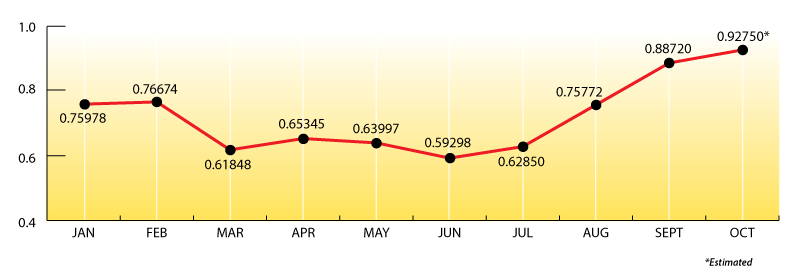

Here are the Mt. Belvieu monthly averages for the past 10 months with a projection for October:

The Skinny:

Propane will stay in America if it's contracted to stay here. Take a look at your upcoming propane requirements. If you're under-contracted, cover your anticipated shortfall with additional supply from Ray Energy.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our email newsletter here.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.