North Amercian Propane Inventory

When I started in the propane business in 1989, the price of propane moved about a penny per gallon per year. The rule of thumb was 60 million barrels of propane inventory by the end of October would yield an adequate inventory level to withstand normal winter demand. Now, of course, we often see the price of propane move several cents per gallon every day, and most experts believe 70 (million barrels) is the new 60.

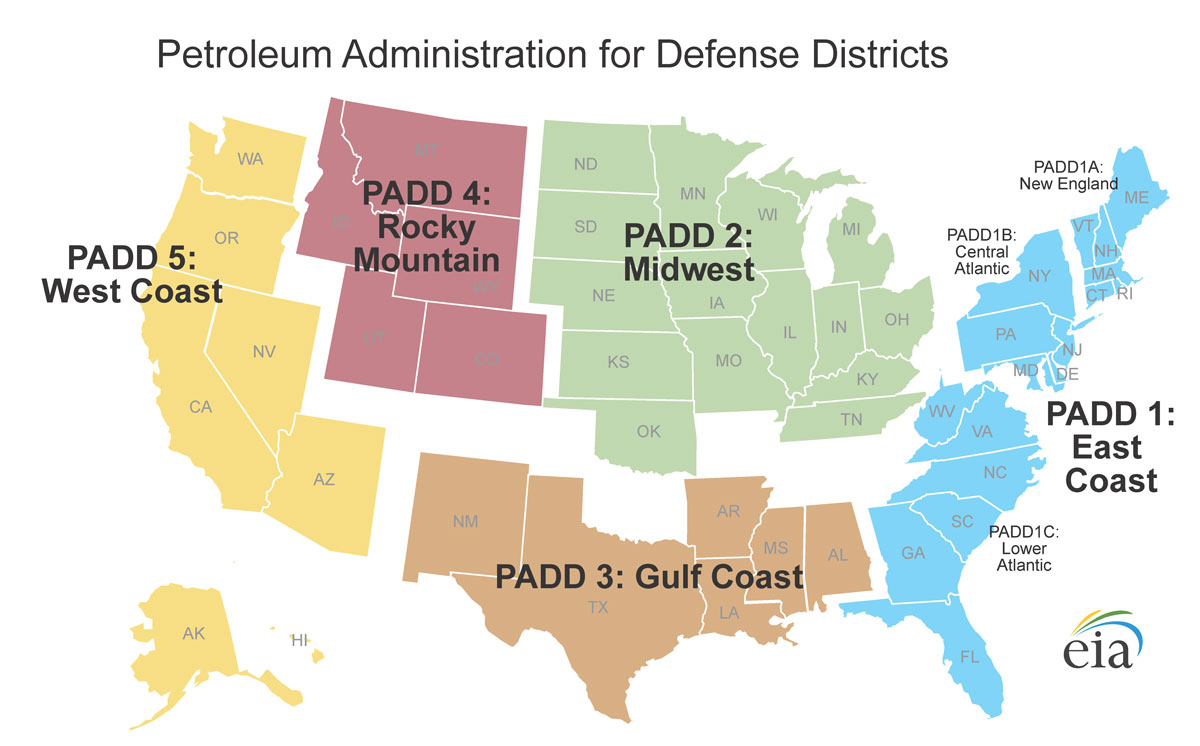

During World War II, regional US districts were created to organize the allocation of gasoline and diesel, among other petroleum products. The five Petroleum Administration for Defense Districts (PADD) include the East Coast (PADD 1), the Midwest (PADD 2) and the Gulf Coast (PADD 3).

During World War II, regional US districts were created to organize the allocation of gasoline and diesel, among other petroleum products. The five Petroleum Administration for Defense Districts (PADD) include the East Coast (PADD 1), the Midwest (PADD 2) and the Gulf Coast (PADD 3).

As of June 8, US inventories stand at 77.3 million barrels. The East Coast has 3.7 million barrels, the Midwest has 21.2 million barrels, and the Gulf Coast has 50.2 million barrels. (As you can see, most of the propane in the US is stored a long way from the Northeast!)

A year ago at this time, on our march towards a record-high inventory level of 104 million barrels, we had 78.8 million barrels … so we’re almost exactly where we were a year ago.

What’s changed?

For one thing, Canadian propane inventory levels are roughly 50 percent lower than a year ago. The days of paying a retail company a few cents per gallon to come into a western Canadian gas plant to load on a weekend (true story) are gone. One-hundred car unit trains of crude that regularly headed east from the Bakken Region of North Dakota no longer do so. And, the number of rigs exploring for oil and natural gas dropped recently to a new all-time low … more than 50 percent less than a year ago.

In contrast, and acting as a price support against lower propane prices in the East, large numbers of propane railcars now head in the opposite direction, from the Marcellus region westward to Conway, KS, and south to Mexico. Because export margins for US propane are much tighter than a year ago, we see export levels wobbling dramatically from one month to the next -- from soaring export demand one month (January) to an unexpected export decline the following month (February). This monthly inconsistency led to a surprising, but not completely unexpected, propane inventory draw in late May. And if export margins improve, we could see further weekly draws throughout the summer.

In summary, propane prices in Mt. Belvieu, TX, are about $0.10 per gallon higher than they were a year ago. That’s not a bad price level, all things considered, as it’s unlikely we’ll see the steep price discounts we saw last summer.

As a result of the mild winter, most retailers understandably contracted less total volume this year. But that may create more spot demand, which will support prices.

In real estate, they say location is everything. Well, there just isn’t the same level of distressed product in North America there was last year, especially in the locations that have limited storage options or take away capabilities.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.