Prebuy Prices & Backward Markets

How do we make sense of this year’s propane market compared to last year?

Standing at the Top of a Stairway.

A market in backwardation is never conducive to inventory building.

Why? Imagine for the moment that you make propane. Then look at the monthly price chart below and ask yourself, “Am I better off selling new propane production in April or incurring storage expenses and selling it in December?”

On the flip side imagine that you’re a buyer for an Asian petrochemical company. You have a choice of feedstocks and with propane prices 60 percent of the value of crude oil recently (on the high side), you may look at the monthly price chart above and ask, “Do I absolutely need to buy propane now?”

This tug of war between reluctant buyers and limited sellers of tight supply often occurs whenever low inventory levels of almost any commodity creates a prompt or “wet” premium.

Strong export demand the past few months, low Gulf Coast inventory levels (40 percent behind last year!), and the assumption that future supply will greatly outpace demand are the main reasons why we’re standing at the top of the stairway looking down at lower prices, instead of looking up from the market bottom like last year.

How Does Pricing This Coming Winter Compare to Last Year?

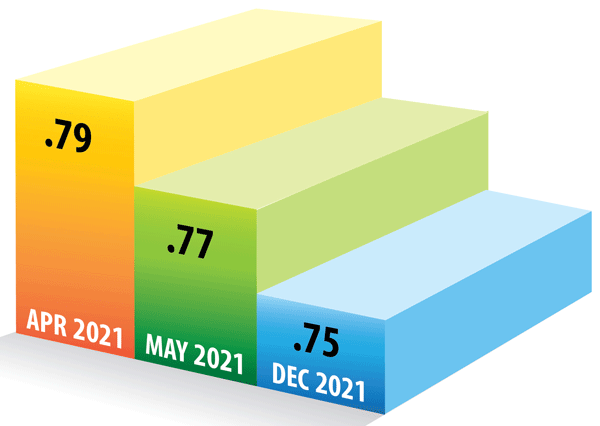

The Belvieu price difference last April versus this April is roughly $.50 per gallon.

But thanks to the contrast between a 2020 market that was in contango (worth more each forward month) versus a 2021 market that’s in backwardation (worth less each forward month), the winter strip difference is much narrower … only about $.30 per gallon.

What Happens Next?

The current market structure is telling us that today’s fundamentals are not indicative of tomorrow’s reality.

Export demand has been weakening (down 31 percent versus last year, down 37 percent week to week) while Belvieu supply will start to build (both directly via pipeline from Conway, KS, and indirectly via railcars from Conway-priced markets into Belvieu-priced markets) and propane prices will likely continue to move towards a more balanced 55 percent of the price of crude oil.

Fixed Prices.

It’s also possible – and perhaps likely – that prices for the winter months won’t soften nearly as much compared to April. Propane prices for both the current and future months could flatten before commencing an autumn metamorphosis into a slight premium for the winter months.

So this may be a good time to pre-buy if that’s something you’re interested in. It’s worth noting that because fixed prices are higher than last year, a lot of folks are still waiting to buy the next dip. That’s understandable. But what if there is no next big dip?

Don’t assume that April weakness will translate to further weakness in the winter months.

Ray Energy’s Prebuy Program.

- Ray Energy index-priced contracts can be converted to a fixed-price contract at any time.

- Layering in your fixed-price purchases is an excellent way to mitigate risk and build a solid foundation.

Price Forecast.

In January’s blog I estimated that Belvieu propane prices could be around $.7790 per gallon this summer, slightly higher for next winter.

I know the “slightly higher for next winter” part is contrary to the endless backwardation in the crude market but I think that’s still a good forecast.

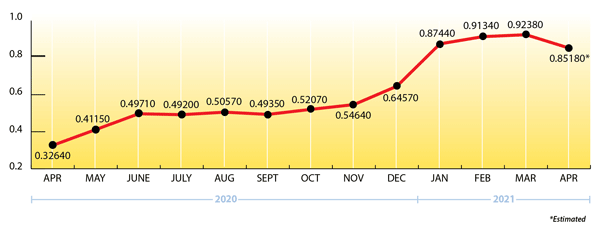

Propane Price Chart

Weekly Inventory Numbers

U.S. propane inventories showed a build of 1.01 mmbbls. for the week ending April 9, 2021. That brings national inventory levels to 40.58 mmbbls., about 28 percent behind last year and 16 percent behind the 5-year average.

PADD 2 (Midwest/Conway) inventories had a healthy build of .898 mmbbls. They currently stand at 9.79 mmbbls., roughly 7 percent behind last year.

PADD 3 (Gulf Coast/Belvieu) inventories recorded a nominal build of .378 mmbbls. They currently stand at 24.88 mmbbls. and are nearly 40 percent behind last year.

The Skinny

Thanks to the contrast between a 2020 market that was in contango versus a 2021 market that’s in backwardation, the winter strip difference (year to year) is only about $.30 per gallon.

So if you plan to pre-buy for next winter, this may be a good time to get started!

For more prebuy pricing information, you can reach our Ray Energy marketing team here:

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2021 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.