Price Correction or New Price Trend?

One of the hardest calls to make is whether a healthy price correction (retracement) is just that or if it is actually the start of a new price trend (reversal).

Some Background

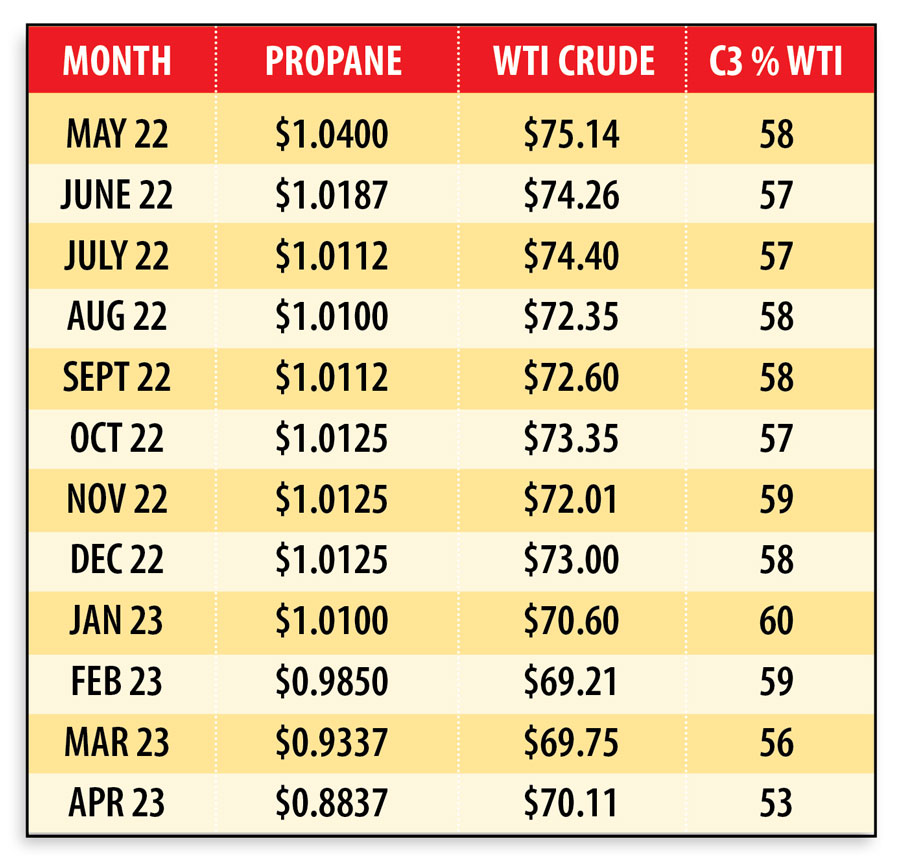

Belvieu propane prices rose about $.70 per gallon from April through October. This was mostly due to a $25.00 bbl. increase in crude prices and partly due to low Gulf Coast inventory levels.

Propane prices have since come off about $.19 per gallon from the beginning of November and more than $.25 per gallon from the October high point.

Will It Last?

The recent price drop is welcome relief for commercial accounts and consumers, and it gives retail companies a chance to gain back some of the margin they may have lost on the ride up, but I don’t think we’re out of the woods yet. I’d be very surprised if we’ve seen the last of high energy prices this winter.

Buy The Dip.

Here is the case for “buying the dip” whether it’s locking in the price for a portion of your winter volume or taking advantage of discounted future months and locking in the base price for a portion of next contract season’s propane supply.

Bank of America energy analysts recently increased their oil price forecast for 2022 to $82.00 bbl. (WTI) with the potential for prices to trade as high as $120.00 bbl. (Brent) during the first half of the year.

If you’re comfortable fixing a portion of your future energy costs for budgetary purposes, consider locking in a portion of your winter volume or layering in the base price for a portion of next year’s propane supply.

Why? Future propane prices are roughly $.25 per gallon lower than today’s market and nearly $.50 per gallon lower than the October high point.

They’re also fairly priced as a percentage of crude. Unlike the current 65 percent (propane to crude), which is based on Gulf Coast inventory levels that are more than 30 percent lower than the previous two years, the forward months are tracking near 57 percent which is closer to the historical average and reflects the expectation that future inventory levels will be closer to normal.

Future propane prices aren’t inflated relative to future crude prices.

The Math.

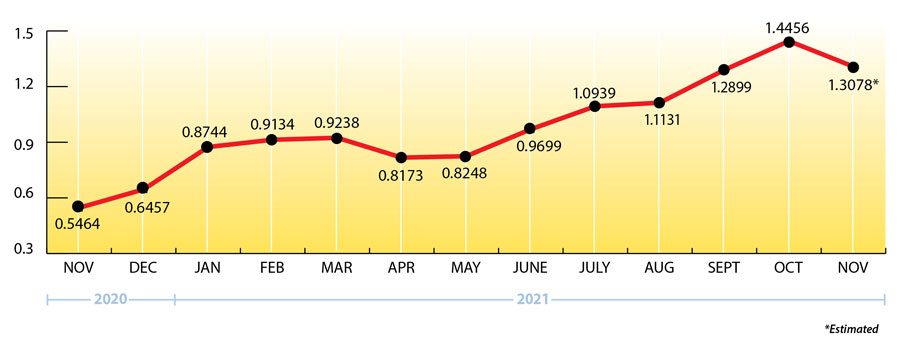

Here’s a chart that shows the forward month discount in the propane market:

The Best Buying Opportunities.

The best buying opportunities in backwardated markets are in the future months. This is especially true if the forward months are fairly heavily discounted, like they are now. But there is always risk involved when buying something at one number and waiting to sell it at another number; careful thought needs to go into how much risk (if any!) you’re willing to assume.

Plan ahead. It’s never been more important!

On a separate note, this is a uniquely challenging time and supply chain shortages are affecting every industry including the propane industry. Now that winter is on our doorstep, please plan ahead when scheduling propane orders and deliveries. It’s never been more important

What's Happening With Propane?

Propane Price Chart

Weekly Inventory Numbers

U.S. propane inventories showed a slight draw of .19 mmbbls. for the week ending November 12, 2021. That brings national inventory levels to 74.57 mmbbls., about 20 percent behind last year and 13 percent behind the 5-year average.

PADD 2 (Midwest/Conway) inventories had a minimal draw of .24 mmbbls. They currently stand at 24.85 mmbbls., roughly 6 percent behind last year.

PADD 3 (Gulf Coast/Belvieu) inventories showed a small draw of .40 mmbbls. They now stand at 35.74 mmbbls., nearly 32 percent behind last year.

The Skinny

The best buying opportunities in backwardated markets are in the future months. This is especially true if the forward months are fairly heavily discounted, like they are now. On top of that, we’ve already seen a nice dip in the current market.

Please contact RAY ENERGY if you’re interested in receiving a fixed-price quote for a portion of your remaining winter volume or if you’re interested in locking in the base price for a portion of the 2022/2023 contract season.

All of us at Ray Energy would like to wish you and your family a safe and happy Thanksgiving!

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2021 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.