Propane Concerns and Energy Independence

We are deeply saddened by the war in Ukraine. Our thoughts and prayers go out to the brave Ukrainian people.

A Reality Check.

During peaceful times we can debate the merit and practicality of working towards a future without hydrocarbons. We have the luxury to argue over proposed energy taxes that go by euphemisms like “climate leadership act” or “alternative compliance payments.”

But in the world that we woke up in today, any legislation that mandates higher energy taxes on consumers, or the elimination of fossil fuel consumption, will be detrimental to our way of life and our liberty.

Energy Independence.

Energy independence is energy security. And energy security directly impacts national security. So ramping up domestic oil and natural gas production, to the extent that it’s possible, should be our top priority.

And let’s be honest, the “green dream” can’t happen overnight anyway. We live in a world where coal is still the leading source of electricity generation!

New Challenges for Propane.

High energy costs will create new challenges. One will be your receivables. The cost of delayed payments is a real cost and should be factored into your budget.

Another issue, which could impact your demand, is that price increases for electricity will lag behind propane. Why? Utilities submit cost of gas filings annually or semi-annually every year, often breaking out the periods of peak and off-peak demand. The filings are subject to a hearing and then subsequent approval by the Public Utility Commission.

Once the rate has been established utilities are only allowed a monthly upward rate adjustment due to increased market conditions by up to 25% of the initial rate.

What Will Turn Prices Around?

Nothing turns rising prices around more quickly than the perception of changing supply dynamics or demand destruction.

The recent pandemic is an obvious example of how quickly demand destruction can lower energy prices. But the greatest predictable impact on consumption will come from large-scale conservation efforts.

What Can You Do?

Energy conservation is going to happen so why not be proactive?

Let your customers know that you’re concerned too about the rising cost of all commodities, as well as goods and services, due to current global events.

And perhaps suggest some ways that they can reduce their home energy bills. For example, a thermostat controls about 60 percent of an annual energy bill. Customers can conserve energy immediately by installing a smart thermostat. It practically thinks for them and folks can expect an average yearly savings of 23 percent on their heating and cooling bills.

What’s Happening with Propane Prices?

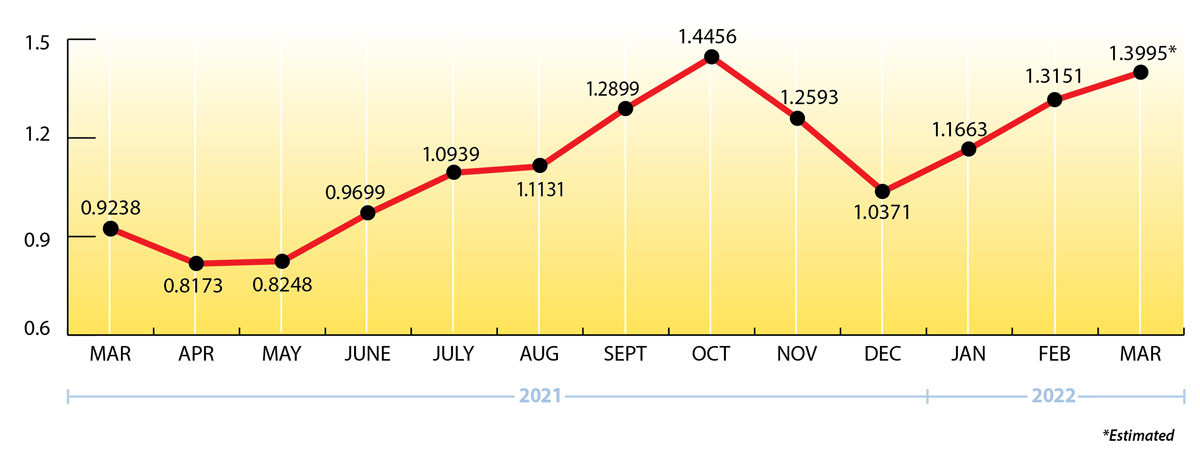

A highly volatile energy market has created roller-coaster price moves for propane during the first half of March. Belvieu prices have risen and fallen over $.30 per gallon.

The rapid rise in crude oil prices widened the LPG (propane/butane) to naphtha price difference in favor of LPG as a preferred petrochemical feedstock. So export demand was increasing at a time when U.S. propane inventory levels have been below normal. Crude prices have been collapsing lately, though, so in terms of export demand we’ll need to wait and see how the dust settles.

Quite often when we exit a winter with low inventory levels and a market in backwardation (which discourages propane storage), we see prices stay on the firm side well into late summer or early fall.

Propane Price Chart

Weekly Inventory Numbers

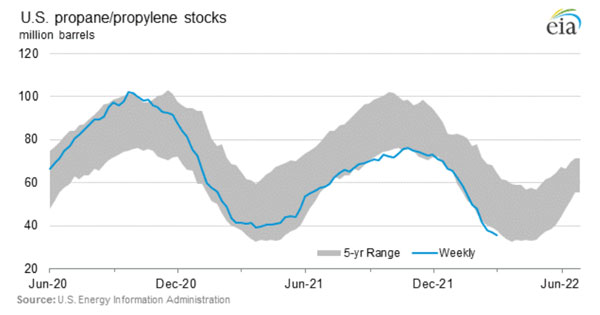

U.S. propane inventories showed a larger than expected draw of 2.22 mmbbls. for the week ending March 11, 2022. This brings national inventory levels to 33.3 mmbbls., about 19 percent behind last year and 25 percent behind the 5-year average.

PADD 2 (Midwest/Conway) inventories had a draw of .83 mmbbls. They currently stand at 8.82 mmbbls., roughly 2 percent behind last year.

PADD 3 (Gulf Coast/Belvieu) inventories showed a draw of 1.11 mmbbls. They now stand at 19.15 mmbbls., nearly 26 percent behind last year.

The Skinny

Propane inventories are low and export levels are high. Unfortunately, propane’s current value to crude, along with the backwardation in the market, won’t incentivize a change in the status quo.

All of this is happening with contract season right around the corner.

So while it looks like this may be one of those difficult years for the propane industry, please be assured that Ray Energy has the resources, market knowledge, and experience to guide you through these challenging times.

We look forward to taking great care of your 2022/2023 propane requirements.

Thank you for placing your trust in Ray Energy!

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2021 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.