Propane Exports Aren't Making Waves ... Yet

Propane exports.

U.S. propane exports aren’t keeping pace with growing propane supply from increased natural gas production which is creating larger than normal weekly inventory builds.

It now seems likely that U.S. propane inventory levels will surpass the 5-year average before July.

Lower terminal loading fees are the best indication of spare dock capacity and they were as low as $.04 per gallon not long ago but bounced back late last week towards the $.06 per gallon range.

Export Q&A with Simon Hill.

We caught up with Simon Hill recently to ask him a couple of questions about the export market. Simon is a 40- year industry veteran who writes a great weekly blog (Simon Says) that offers insights, opinion, and analysis with a strong global perspective on international shipping and trading.

First, some helpful notes:

- 42 gallons in a barrel.

- 12.4 barrels (or 521 gallons) in a metric ton (Mt) of propane.

- ARB, short for arbitrage. Think “window of opportunity” which is open or closed (based on price) for selling a cargo into a particular market.

Heffron: Most of our customers know that propane export demand exceeds all other forms of domestic demand. They are also sometimes painfully aware of the impact that propane exports can have on Belvieu pricing. But most folks aren’t familiar with some of the terminology and how the math works between the Gulf Coast or Marcus Hook and various global destinations.

Last month you mentioned that “The ARB has kept steady around the $150/Mt level.” Could you please translate that and elaborate on it?

Hill: Propane exports, like seasonal demand and price sensitive petrochemical demand, fluctuate according to price. Exports are a significant demand component and are usually below winter domestic demand numbers but tend to jump above them in the summer.

And the price for exports is related to the ARB, which is the gap between prices in Asia, usually the Far East Index price, and Mont Belvieu propane for any given period. The paper derivative markets use TET, but that’s not a given. Recently this has been around $150/Mt wide. Usually traders look at the next 30- to 60-day period in the U.S. and given 40 days to reach Asia on average, they’ll be selling in the following month.

And the price for exports is related to the ARB, which is the gap between prices in Asia, usually the Far East Index price, and Mont Belvieu propane for any given period. The paper derivative markets use TET, but that’s not a given. Recently this has been around $150/Mt wide. Usually traders look at the next 30- to 60-day period in the U.S. and given 40 days to reach Asia on average, they’ll be selling in the following month.

Once you have the ARB, there are two important components to determine whether the ARB is open or closed: Terminal fees and freight. Most players look at spot rates. So if the terminal fees at Enterprise, for example, are 6 c/g ($31.2/Mt) and the freight is $115/Mt, the ARB is deemed open. If the freight was $135/Mt, then it would be closed, pushing more cancellations or the entry of Enterprise as a buyer.

That’s the simple version, but there’s always a surprise or two!

Heffron: You’ve mentioned that 45 Very Large Gas Carriers (VLGCs) which is about 20 percent (?) of the total waterborne fleet size, will soon be brought into service, most within the next 8 months or so. All things being equal, it seems like that could boost export demand later this year. What do you see as the biggest impact from this increase?

Hill: It’s about 15 percent of the fleet but that depends on the number of older VLGCs getting scrapped. When rates are high, older ships keep going, but if there’s an oversupply, then rates may fall below CAPEX and OPEX levels. If so, older ships become more uneconomical and may be demolished – the knackers yard.

The impact looks like lower freight levels as owners compete for charterers. Whether it will create more cargoes is not just in the ship owners' hands.

The ARB still does the work!

Heffron: Thank you very much Simon.

What’s Happening with Propane Prices?

Weekly propane inventory builds have been exceeding industry expectations for a while, pushing propane’s value as a percentage of crude down towards the 44 percent (very low end) range.

The price direction of crude oil will still determine whether propane prices move up or down, but if this lower value trend continues for propane, it will start to stimulate export demand while pushing the current month and future months toward each other, flattening out most of the steep backwardation that's been in place, further encouraging inventory building.

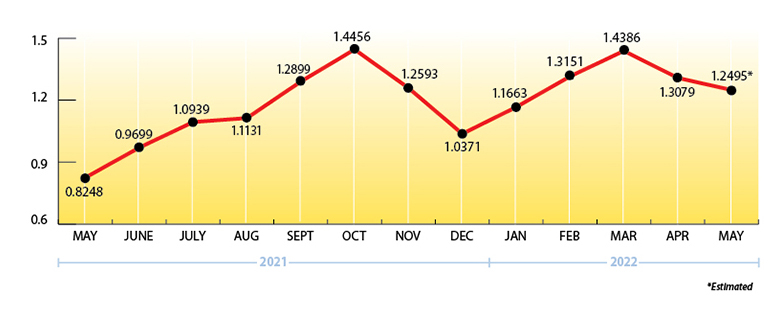

Propane Price Chart

Weekly Inventory Numbers

The first draw in the Gulf Coast since March, following an enormous Gulf Coast build last week, was responsible for U.S. propane inventories to show only a minor build of .29 mmbbls. for the week ending May 13, 2022, well below industry expectations.

This brings national inventory levels to 44.51 mmbbls., largely unchanged from last year and 10 percent below the 5-year average.

PADD 2 (Midwest/Conway) inventories had a build of .48 mmbbls. They currently stand at 9.86 mmbbls., roughly 12 percent behind last year.

PADD 3 (Gulf Coast/Belvieu) inventories showed a surprising draw of 1.02 mmbbls. They now stand at 28.15 mmbbls., nearly 7 percent ahead of last year.

The Skinny

Propane exports exceed all other forms of domestic demand so they obviously have a big influence on inventory levels and prices. It’s important to understand the concept of things like whether the ARB is open or closed, where propane prices are trending as a percentage to crude, and whether or not there is sufficient shipping capacity.

We try to write about all of the factors that can influence propane supply and demand, as well as pricing considerations, legislative issues, and subjects like renewable propane, because we know how important this is to you.

We hope that you find our newsletter and this blog interesting and informative.

Thank you for doing business with Ray Energy!

Simon Hill provides advisory services and can be reached at Cazbaa Energy.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2021 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.