Propane Impact from Philly Refinery Closing

Everything is interconnected. So when Philadelphia Energy Solutions (PES) CEO Mark Smith announced a few weeks ago that the Philadelphia refinery would be closing for good, following a massive explosion in late June and years of financial challenges, it changed the US petroleum landscape.

What a Difference a Century Makes!

A Philadelphia magazine cover in 1917 read: “Atlantic Petroleum Products carry the name of Philadelphia to all parts of the world.” And that was true!

Started as a storage facility in 1866, it quickly became one of the largest refineries in the US, exporting 35 percent of all US petroleum products to countries all over the world.

What Does This Mean for Propane Supply?

Propane is a necessary by-product (about 2 percent) of the crude oil refining process. A 335,000-barrel-per-day refinery will typically produce about 280,000 gallons per day of propane.

That propane was earmarked for the Marcus Hook Industrial Complex (16 miles down the Delaware River) to meet local and export demand. It seems likely that the propane deficit caused by the Philly refinery closing will require a significant increase in propane supply to Marcus Hook either by pipeline (Teppco and ME2) or by railcar (if there is offload rack capacity) to meet contractual export commitments.

Timing is Everything.

The timing of the newly needed propane supply will be critical. Roughly one-third of the propane supply at Marcus Hook is needed to load a very large ship. Instead of receiving a daily source of propane supply from neighboring Philly, the replacement supply will need to travel a much greater distance.

Why is Spot Supply Cost Rising?

The cost of spot propane supply has been running flat to a premium so far this summer compared to term contract economics. Why?

- The price of propane was recently at its lowest level in 3 years (about 50 percent lower than last year at this time).

- The forward market is in contango (worth about 2 cents per gallon more each month through January).

- Propane is trading at a historically low percentage to crude oil prices (around 34 percent). This is about 20 percent lower than average (the equivalent of about 27 cents per gallon).

- There are new export options in the Gulf Coast starting Q4.

For the four reasons above (and I’m sure there are more), most gas processors would rather store uncommitted current propane production for delivery this coming winter than to discount it heavily now.

It’s unusual for this time of year, but understandable.

What’s Happening with Propane Prices?

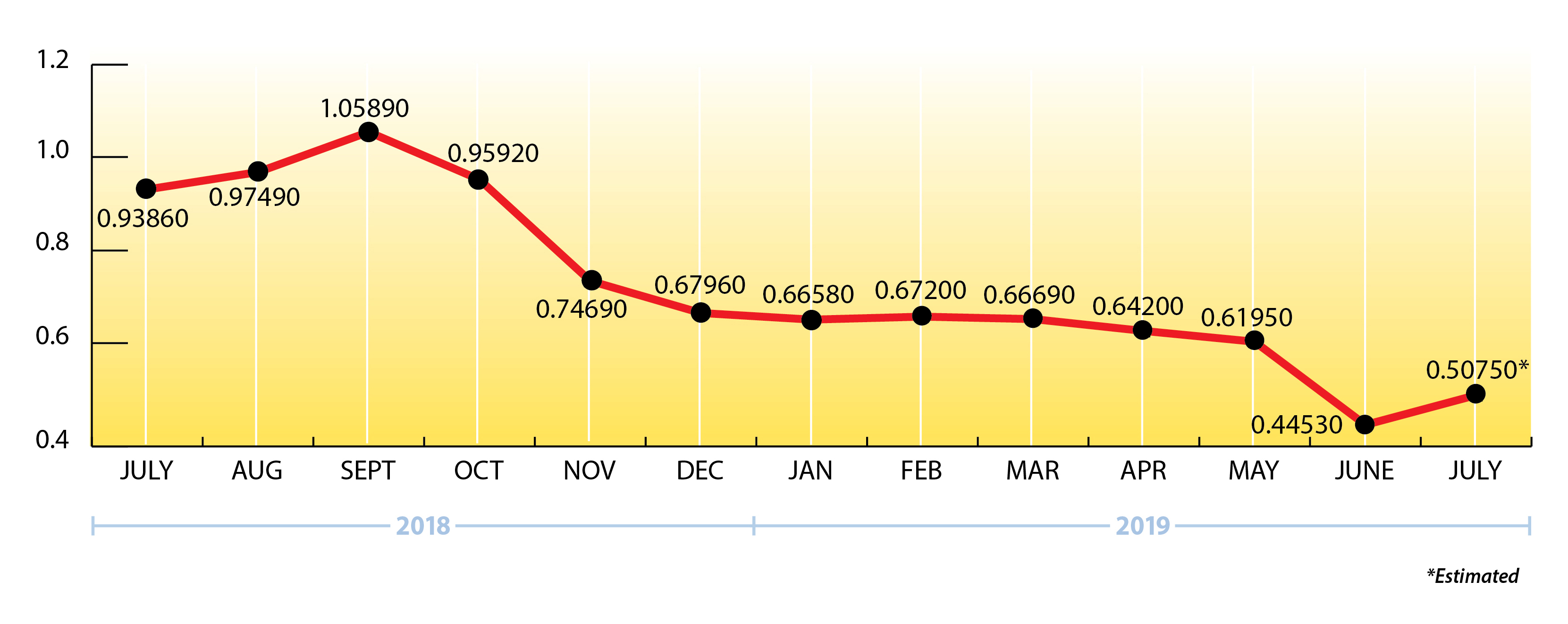

The lowest monthly price for Belvieu propane last year was in December. The lowest monthly price for Belvieu propane this year may have already occurred in June.

EIA Weekly Numbers

Total US propane inventories showed a minimal build of .544 mmbbls. for the week ending 7/12/19. That brings national inventory levels (excluding non-fuel use propylene) to 73.153 mmbbls., about 17 percent higher than last year, but only 5 percent ahead of the five-year average.

PADD 2 (Midwest/Conway) inventories showed a build of 1.134 mmbbls. They currently stand at 22.591 mmbbls., about 4 percent above last year’s level.

PADD 3 (Gulf Coast/Belvieu) inventories showed a surprising draw of 1.216 mmbbls. They currently stand at 42.408 mmbbls. (excluding non-fuel use propylene), roughly 32 percent higher than last year.

The Skinny

The cost of extra propane supply has been running at a premium versus term contract economics for a while now. Things can change quickly, but a major source of Eastern US propane supply has been removed from the market, so the Philly refinery closing may only reinforce this counter-seasonal spot price trend.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.