The Brent Goose

Why is Propane as a Percentage to Crude Oil Significant?

With the recent surge in U.S. crude oil production, we’ve seen increasing mention of the phrase “propane as a percentage of crude oil.” But what exactly does the phrase mean, and why is it important?

First, let’s take a look at what it means.

There are two major trading hubs for crude oil: Brent and West Texas Intermediate.

There are two major trading hubs for crude oil: Brent and West Texas Intermediate.

Brent designates a light (low density), sweet (low-sulfur content) quality of crude oil, originally from the North Sea. The name “Brent” came from Shell Oil naming a North Sea oilfield after the Brent goose. It is traded on the Intercontinental Exchange (ICE).

The other major trading hub for crude oil is West Texas Intermediate (WTI), which is traded on the New York Mercantile Exchange (NYMEX).

So, let’s assume WTI crude oil is trading at $48.00 bbl. We need to translate barrels to gallons, so divide $48.00 by 42 (gallons per barrel) which yields $1.14 per gallon. If propane is trading at $.6600 FOB Mt. Belvieu, TX, we have propane trading at 58% of the value of crude oil. A week or so ago, it was valued at under 50% and popped right back up.

Why is it important?

In the past few years, propane hasn’t wandered far from 50% of the value of crude oil. But it wasn’t always that way!

Twenty years ago, until about four or five years ago, propane rarely traded under 50% the value of crude oil and was often in the 60% to 70% range. There were some anomalies, which were indicative of extreme swings in supply and demand for either propane or crude oil, but not both at the same time, which created the deviations.

When propane trades much higher than its historical percentage of crude, demand for propane as a petrochemical feedstock (plastic) falls dramatically. We saw this in January when the price for propane spiked to $.9500 that allowed demand for Naptha (think gasoline) to outpace propane as a petrochemical feedstock. In addition, the pace of exports slowed down, we had some unseasonably mild weather, and “Voila!” … the price of propane dropped dramatically.

On the other hand (I can’t help but think of the song by Randy Travis!), when propane trades much lower than its historical percentage of crude, export levels and petrochemical consumption pick up. When that happens at the same time that we have some degree days, we can see inventory levels draw down fairly dramatically.

And now we also need to add the construction of a major new pipeline (Mariner2) into the mix. This pipeline will have the capacity to move four times the NGLs of Mariner1 from the greater Marcellus Shale region to the Marcus Hook docks in Pennsylvania for the export market. For the Northeast propane industry, the timing of this new wild card (Nov. completion date?), in conjunction with all of the other factors pushing and pulling propane prices, may create unparalleled swings in supply availability.

Are we likely to see dramatic swings in supply availability?

I think so. U.S. crude oil production is on pace to reach record levels within the next year.

The previous record-high production level for crude oil was set 47 years ago! But U.S. supplies of propane are 27% lower than last year at this time and 16% lower than two years ago.

EIA Numbers for the Week (3/10/17):

- Propane inventories fell by .8 million barrels (44.5 mmbbls. new total)

Days of Propane Supply:

| 3/15/17 | 2/8/17 | 1/11/17 | 12/9/16 | 11/25/16 |

| 36 |

34 | 55 | 77 | 91 |

What’s Happening with Propane Prices?

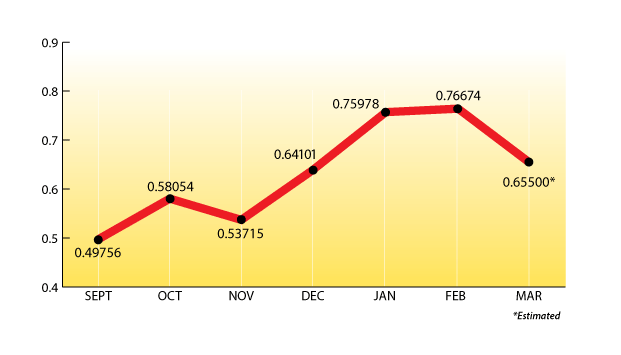

Here are the Mt. Belvieu monthly averages for the past few months with a projection for March.

The Skinny:

Propane as a percentage of crude oil is a useful tool to predict whether propane prices should rise or fall in the short term, relative to the price of crude oil.

It’s interesting and informative, but it doesn’t matter much … especially to the families you keep warm … without a reliable supply of propane delivered to you when you need it, from someone you trust.

Thank you for placing your trust in Ray Energy!

A customer from the east side of the Hudson River recently said, “Stephen, I like to learn more about the propane industry and the things that affect me. I look forward to reading your monthly blog.”

That was a nice compliment and because each reader’s time is so valuable, I’ll try to always keep this blog both interesting and informative.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our email newsletter here.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.