The Hot Topic? Eastern Supply.

U.S. propane inventories were only 11 percent behind the 5-year average recently and weekly export rates have been down (off 40 percent from 2021, 50 percent from 2020) which should put more supply into the domestic market. So why the recent tightness at many Eastern terminals?

The short answer is that propane supply has been going out of most terminals faster than it can be replenished or is scheduled to arrive and the availability of extra supply has been both time sensitive and location specific.

Waiting for Cars to Arrive.

For about a month now, many rail terminals from the Southeast to the Mid-Atlantic to the Northeast have struggled at times to receive railcars in a timely fashion.

To trace things back, some of the issues started in late December with a stretch of colder than normal temperatures in the Northwestern U.S. and Canada. The frigid weather slowed down railcar loading operations at NGL processing and storage facilities in Alberta and Saskatchewan which created bottlenecks and congestion in the holding yards.

COVID-related issues also affected both onsite facility crews (heating huts probably aren’t ideal for social distancing) and railroad crews from western Canada to western Pennsylvania. The reduced manpower impacted projected arrival times for connecting switches, which led to further delays.

But much of the problem has been the logical consequence of what happens when below-normal temperatures occur during the coldest part of the winter.

Pipeline Challenges.

The Teppco pipeline has also been experiencing very heavy demand. One observer told me recently that there were 6 trucks in line at Selkirk, NY, at 9 am and by 12 noon there were 30 trucks waiting, about a 3- to 4-hour wait.

Another challenge has been buying prompt or “wet” spot gas on the pipeline. Why? The Marcellus shale gas plants have done a great job this winter, but they carefully balance production with term sales so there isn’t always much extra, especially during cold weather when they consume more NGLs internally.

Trucking Capacity.

Trucking capacity (manpower and equipment) is still one of the biggest challenges for our industry. So don’t be afraid to thank your propane delivery person when you see them!

Ray Energy

We are proud to say Ray Energy came through with flying colors fulfilling 100% of our contractual obligations and more!

For our part, whether it involves pipeline, railcar, or marine terminal supply, we plan ahead, manage our inventory carefully, and work around the clock to ensure that all customers can receive their monthly contract volumes.

It’s not always easy, so many thanks to our customers for their kind words about our service during these tough times!

What’s Happening with Propane Prices?

The Permian Basin (think west Texas, southeast New Mexico) is the largest producing shale basin (crude oil and natural gas) in North America. To put Permian output into perspective, crude oil production of 5 mmbbls./day equals half the daily output from Saudi Arabia!

The projected U.S. shale response to the highest crude oil prices in 8 years, along with relaxed geopolitical tensions, has one major investment firm forecasting $65.00/bbl. Brent crude by December. But another major investment firm believes that Brent crude will average $105.00/bbl. in 2023.

These forward projections would put Belvieu propane in a $.85/gallon to $1.45/gallon price range using a $3.00/bbl. Brent/WTI spread and 58% propane to crude value for the calculation.

Which one will it be?

I would like to see the lower price projection for our customers. But, from my perspective, expectations for substantially lower prices are not aligned with the current actions, capabilities, or motivations of producers.

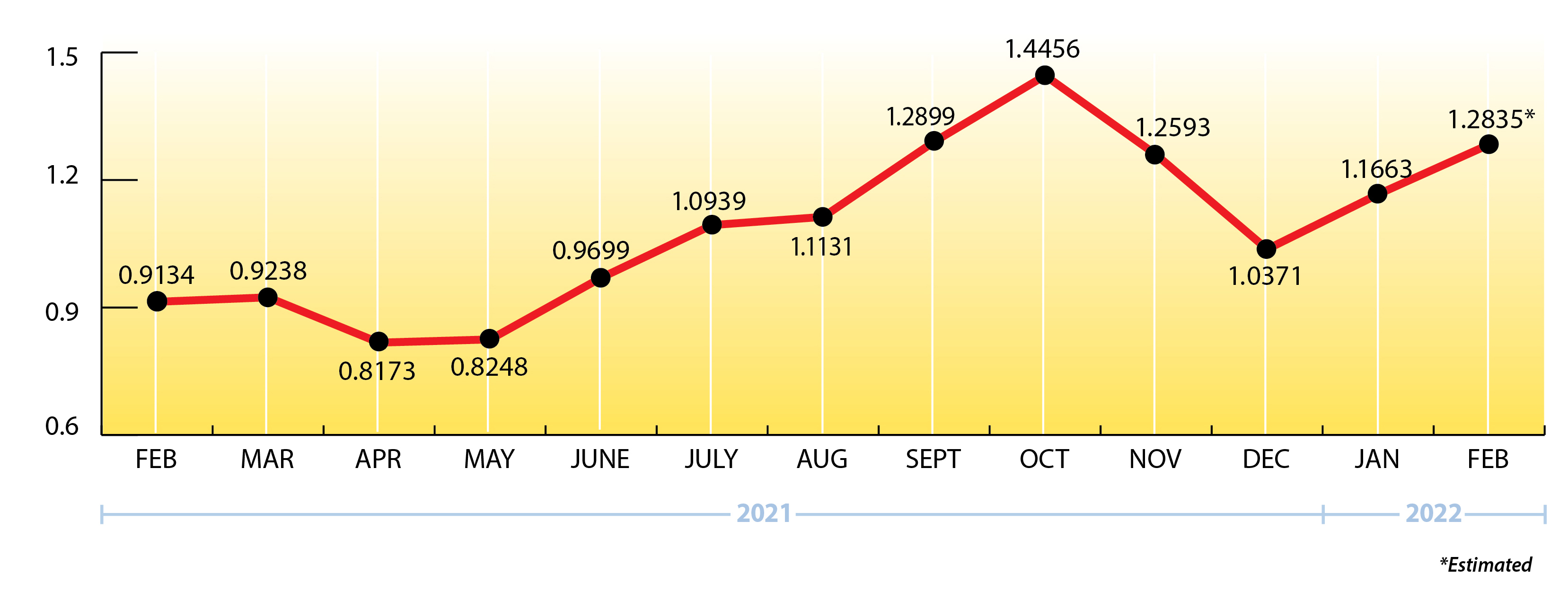

Propane Price Chart

Weekly Inventory Numbers

Partly aided by a strong East Coast draw, U.S. propane inventories showed a large draw of 5.935 mmbbls. for the week ending February 11, 2022, nearly doubling industry expectations. This brings national inventory levels to 41.903 mmbbls., about 14 percent behind last year and now 17 percent behind the 5-year average.

PADD 2 (Midwest/Conway) inventories had a healthy draw of 1.851 mmbbls. They currently stand at 12.918 mmbbls., roughly 10 percent ahead of last year.

PADD 3 (Gulf Coast/Belvieu) inventories showed a robust draw of 2.489 mmbbls. They now stand at 21.005 mmbbls., nearly 26 percent behind last year.

The Skinny

The past four weeks have certainly been challenging at times for many propane terminals up and down the East Coast.

Winter isn’t over yet, but the good news is that Ray Energy has been securing additional propane supply to meet your incremental requirements, so please don’t hesitate to ask your sales representative should you need anything extra this month or in March.

We’re in the “Yes!” business.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2022 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.