The Importance of Supply Contracts & Managing Price Risk

Turbulent times require discipline and prudent risk management practices while highlighting the importance of supply contracts.

Turbulent times require discipline and prudent risk management practices while highlighting the importance of supply contracts.

The Value of an Index or Fixed-Price Supply Contract.

The cyber attack on the Colonial Pipeline Company may be short-lived, but it drove up "posted prices" at gas pumps and highlighted the fact that sometimes the catalyst for price turbulence is structural in nature and sometimes it's driven by Nature.

For example, three and a half years ago, Boston had the coldest December in 134 years.

The odd thing was that the price in Mt. Belvieu, TX, was actually falling at the time. But anyone in the Northeast without an index or fixed-price supply contract could only watch as daily posted prices escalated thru the roof.

So there are two significant advantages to having an index or fixed-price supply contract with us and both will give you peace of mind:

- Your supply contracts secure the actual “wet” gallons that you’ll need later on for your customers. The propane you reserve with us isn’t going to China.

- Your index-priced supply contract has firm summer and winter differentials that are tied directly to the underlying base markets (Belvieu or Conway). Your differentials won’t suddenly go up just because demand picks up. This protects you from the “basis risk” that pricing at different locations could move independently of each other.

When Should I Lock In?

Many customers have asked us recently, “When do you think I should convert some of my index-priced gallons over to a fixed price?”

That’s a good question.

The correct answer, in terms of protecting your customers and your margin, is to say that what day you convert from index to fixed is less important than that you always cover 100% of your fixed-price sales with a timely, fixed-price purchase (or purchases) with us, which is the best way to mitigate risk.

But what folks are really asking with that question is, “Are prices for next winter going higher or lower?”

Upside Risk.

My thoughts are that the upside risk to winter months pricing is probably greater than downside opportunity as long as the forward months stay fairly flat, or are weaker than the current month, and inventories are slow to build.

Why? Producers will likely be disinclined to produce more oil and natural gas than the market is currently requesting as that means assuming the cost and risks associated with storage and softer future prices.

And the best indication that the market is flat is that you can buy a gallon of propane in Mt. Belvieu for August or January for the same price.

You don’t see that every day!

The general lack of a forward curve reflects the modest backwardation in the crude market. But it isn’t an indication of healthy Belvieu inventory levels and it isn’t conducive to inventory building.

The proof is in the pudding; Gulf Coast inventory levels showed no “net gain” in April.

A Good Strategy.

A prudent strategy this year may be to make sure that you have at least enough fixed-price supply on hand (which you can layer in) to cover the projected sales from your fixed-price sales programs or any other fixed-price sales. You can always convert more as needed.

What’s Happening with Propane Prices?

The price for Belvieu propane dropped from the $1.00 per gallon range in early April to the $.70 per gallon range by mid-April and then bounced around in-between from late April into early May.

Strong commodity demand, a weaker dollar and inflation risks will likely keep propane prices from dropping much further (at least in the short term) and I should probably bump up the Belvieu summer price forecast from $.7790 to $.8520.

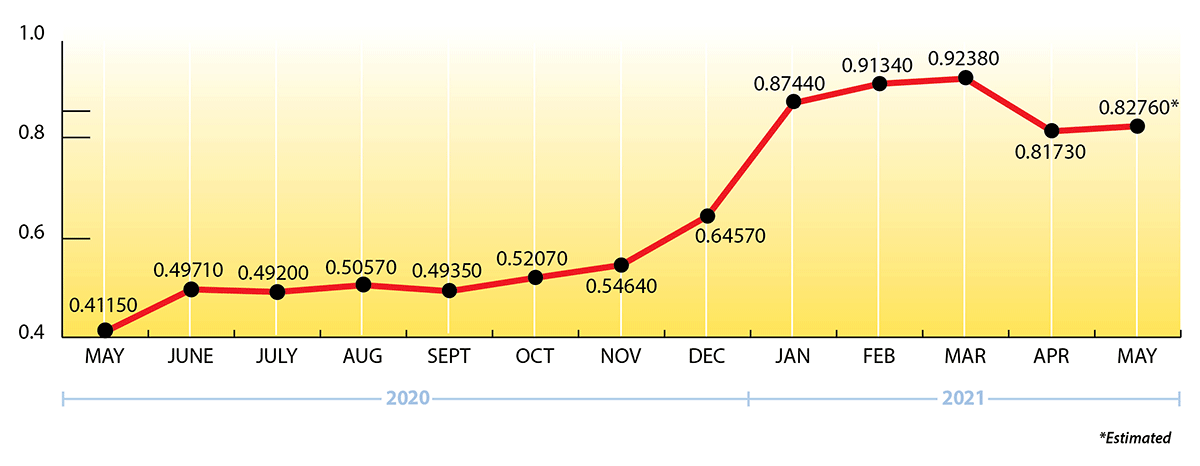

Propane Price Chart

Weekly Inventory Numbers

U.S. propane inventories showed a larger than expected build of 2.54 mmbbls. for the week ending May 7, 2021. That brings national inventory levels to 44.01 mmbbls., about 29 percent behind last year and 17 percent behind the 5-year average.

PADD 2 (Midwest/Conway) inventories had a modest build of .63 mmbbls. They currently stand at 10.71 mmbbls., roughly 17 percent behind last year.

PADD 3 (Gulf Coast/Belvieu) inventories recorded a healthy build of 2.0 mmbbls. They stand at 26.82 mmbbls., nearly 35 percent behind last year.

The Skinny

Given much lower than normal propane inventory levels, a prudent risk management strategy this year may be to make sure that you have enough index-priced supply purchased with us to cover your projected annual requirements and at least enough fixed-price supply on hand to cover the projected sales from your fixed-price sales programs. Don’t be caught short!

You can always convert more index-priced supply over to a fixed-price as needed.

Supply contracts from Ray Energy will give you peace of mind and assure you of a reliable supply of propane.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2021 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.