The Only Constant Is Change

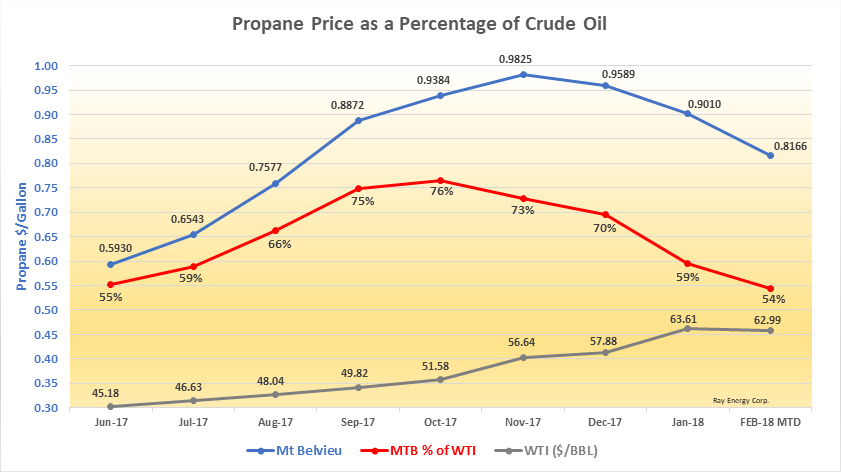

Last month we mentioned that “crude and propane prices have been moving in opposite directions, allowing propane to become a much more attractive petrochemical feedstock than naphtha. This should start to make a big difference in international propane demand.”

What a difference a month makes!

- Falling domestic propane prices relative to crude oil created a predictable result. Propane is more favored versus naphtha as a petrochemical feedstock than it’s been in 1.5 years.

- Export demand was weak last month, but looks strong in February.

- Propane as a percentage of crude oil was in the 76% range; now it’s in the 54% range.

What about pre-buy?

Last Thursday, when Belvieu was in the $.77 range, several customers asked me “Is this a good time to start locking in some fixed pricing?”

It’s a great question.

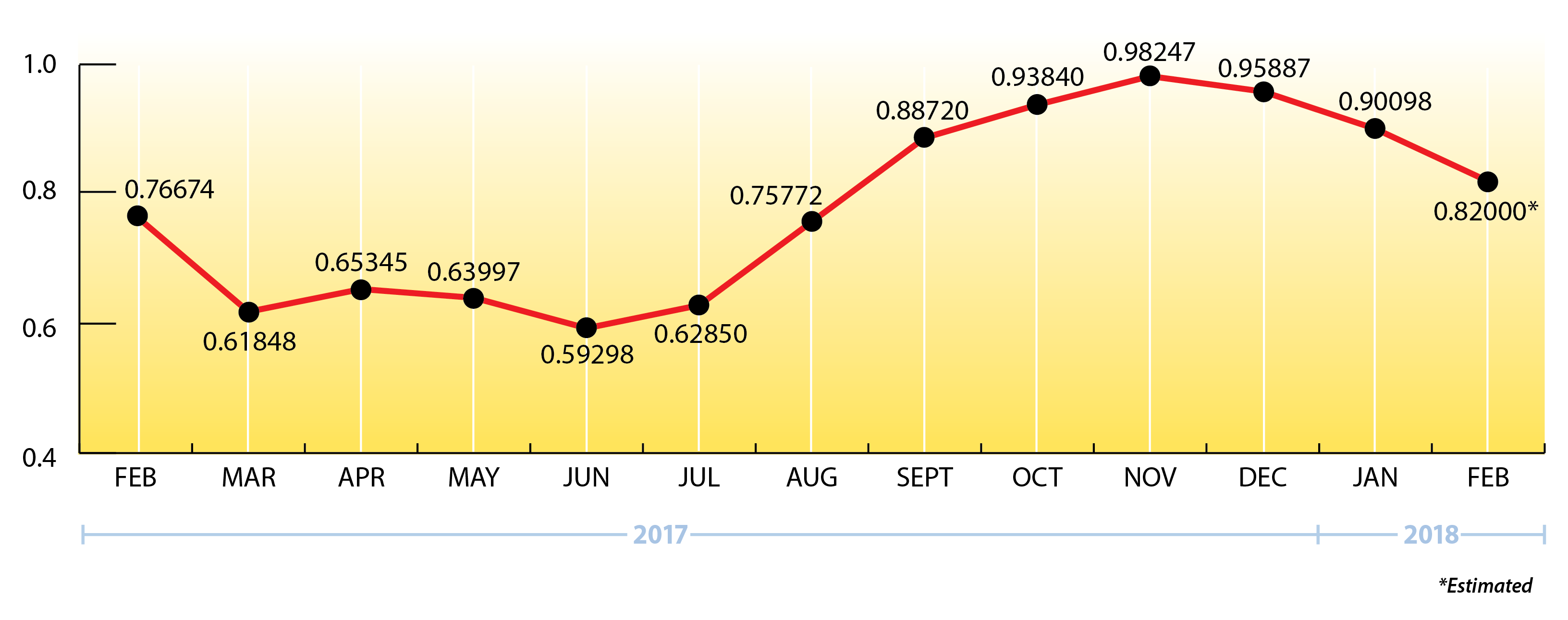

I’m sure many of you are wondering the same thing. After all, propane prices are lower than they’ve been since August. But when is the best time?

Now that export demand rules the roost, the lowest monthly price each year can occur in any month.

What should we look for if we can’t use past history?

We can’t use seasonal clues anymore since everything has been turned upside down. Inventory builds in the winter and draws in the summer are commonplace.

But there are other trends and clues to look for, and propane as a percentage of crude is an important factor in determining future demand.

Propane is trading at 54% of the value of crude oil which is probably unsustainable. US inventory levels are down to below average levels, while international demand is picking up.

Can I lock in forward month pricing now?

Yes.

We’ll be rolling out our May 2018 thru April 2019 propane supply program soon which will include summer and winter differentials. But in the meantime, if you’re interested, we can lock in the base price with differentials “to be determined.” For a competitive pre-buy quote, please reach out to Justin Ray at 518-874-4510 or justinray@rayenergy.com. I know Justin would love to hear from you!

Index is back.

Every spring following a challenging winter, when spot supplies are needed to keep up with unexpected demand, there is renewed interest in greater index pricing.

I think all of us would like to avoid spot market pricing next winter if possible. Contracting with us for a greater percentage of your upcoming requirements will help.

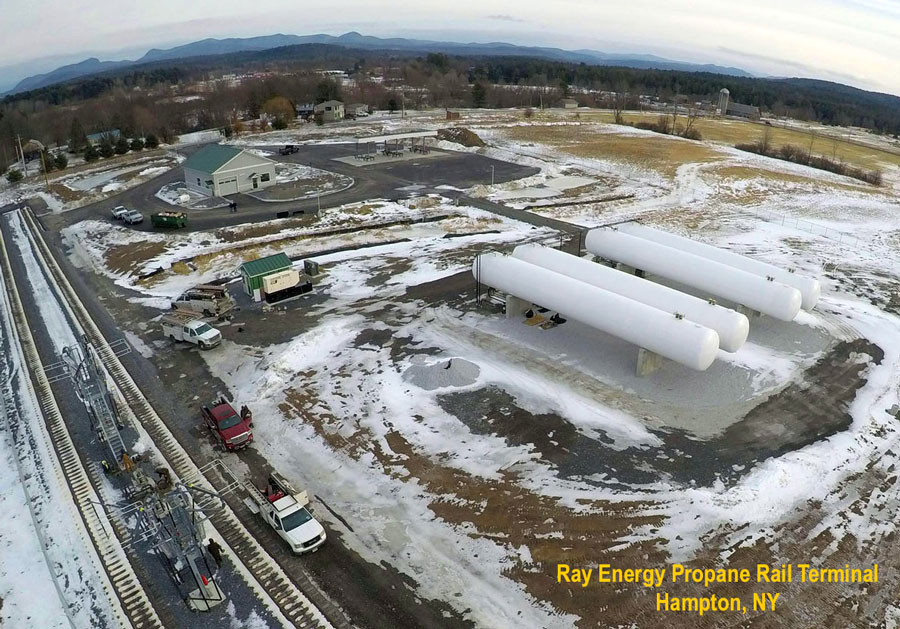

The Serenity Prayer contains the line “the courage to change the things I can” and we’re taking that to heart. We’re making big changes to the Northeast supply and distribution infrastructure.

The Serenity Prayer contains the line “the courage to change the things I can” and we’re taking that to heart. We’re making big changes to the Northeast supply and distribution infrastructure.

Our new propane rail facility in Hampton, New York, will be fully operational within a few weeks. We’re very excited to add millions of gallons of new supply and distribution capacity for the Northeast. It will keep more propane supply right here.

What’s happening with propane prices?

In our December blog, we wrote that while “no one can predict the future, it seems likely that the Belvieu propane market has tested resistance in the $1.00/gallon level and will now overreact to the recent lack of export demand and correct back towards the $.80/gallon level.”

The Belvieu price actually went lower than that last Wednesday, reaching the $.77/gallon mark. The last time we saw lower prices was in August.

So the question becomes did last Wednesday mark the end of a substantial market correction, and now we’ll move higher again? Or was last Friday a “dead cat bounce”, an impressive but short-lived price reversal, and now we’ll take another leg down?

I think the sudden increase in the price at Belvieu late last week and early this week was artificially driven. I'm leaning towards the "dead cat bounce" theory and believe that we may take another leg down soon.

If the price of crude oil trends lower, but finds support near $56/bbl., we could see Belvieu propane prices move back towards the low to mid $.70 range.

EIA weekly numbers::

US propane inventories for the week ending 2/9/18 had a draw of 3.3 mmbbls. (45.6 mmbbls. total) or 14.1% behind last year for the same time period.

Conway, KS, inventories drew down 1.0 mmbbls. to 11.8 mmbbls. total which is 2.9 mmbbls. or 20% less than inventories at the same time last year.

Mt. Belvieu, TX, inventories drew down 1.3 mmbbls. to 29.2 mmbbls. and are 8.5% less than last year.

The Skinny:

With Ray Energy, you’ll never have to travel far to find the propane you need to keep your customers warm. We encourage you to contract at least 95% of your projected propane requirements this year with us on an index basis. We can always convert a portion of your index contract to a fixed price when you’re interested.

We're opening a major new propane rail terminal in Hampton, NY, next month which will increase propane supply right here in the Northeast. And it will further assure our customers that Ray Energy has the most reliable supply of propane in the business.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our email newsletter here.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.