The Yin and the Yang

After April with its sweet showers

After April with its sweet showers

Has pierced the drought of March to the root

And bathed every vein in strong liquor,

Nascent flowers, waking, may emerge.

(Chaucer translation by S. Heffron)

It may seem odd to combine Chinese philosophy with an English poet from the 1400s, but seemingly contrary forces are often interconnected. This principle is certainly present in the enormous gulf between Conway and Belvieu propane prices as well as long and short positions in the crude future market.

What Goes Wide Must Go Thin

Last Wednesday, the EIA reported that Gulf Coast propane inventories were unchanged from the prior week, but showed a 200K bbl. draw in the Midwest. Today's EIA report showed a 200K bbl. build in the Gulf Coast and another 200K bbl. draw in the Midwest. Rather than contracting, the spread between Conway and Belvieu actually widened after the report, approaching .14 cents per gallon.

Since the cost to ship propane by pipeline from the north to the south is only a fraction of the current spread … what the market is saying is: “There isn’t enough pipeline capacity to transfer propane south. We believe that future inventory builds in the Midwest will outpace those in the Gulf Coast.”

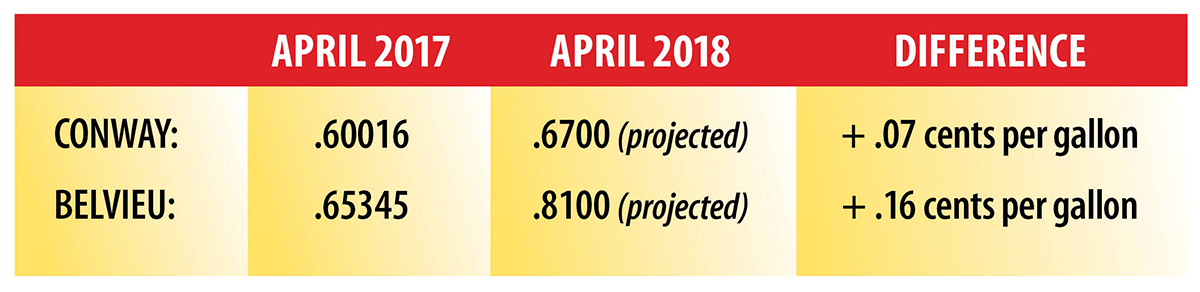

Here’s a chart that shows the difference a year makes in Conway/Belvieu month-end pricing:

Note that while Conway, KS, prices are .06 cpg higher than last year, Mt. Belvieu, TX, prices are now .16 cpg higher than last year!

For further perspective, three months ago the spread between Conway and Belvieu was about 3 cents per gallon (close to its historical average). Now it’s nearly 14 cents per gallon (the yin).

My thoughts:

- Conway, KS, inventory builds may lag behind Mt. Belvieu, TX, this spring and summer.

- If that happens, Conway, KS, prices may be higher than Mt. Belvieu, TX, prices by December (the yang).

Pigs Get Feed, Hogs Gets Slaughtered

Everyone is bullish on crude prices. And why not?

- OPEC production is at a 12-month low, and under their production cut quotas.

- Global inventories of crude oil are more balanced than they’ve been in years.

- Venezuelan, Algerian, and Libyan production is a mess.

- The 2015 Iran nuclear deadline to waive or renew sanctions is now less than a month out. Uncertainty surrounding the decision is bullish.

Meanwhile, long positions (bets that the market is going higher) from major hedge funds for domestic and international crude futures combined are nearly 16 times greater than short positions (bets that the market is going lower).

And Saudi Arabia was so bullish recently on crude prices that they raised the price of their May exports to China substantially. China responded by cutting their May crude orders with Saudi Arabia almost in half. Then they picked up the slack from Russia.

“Spah-SEE-bah” is the Russian pronunciation for “thank you!”

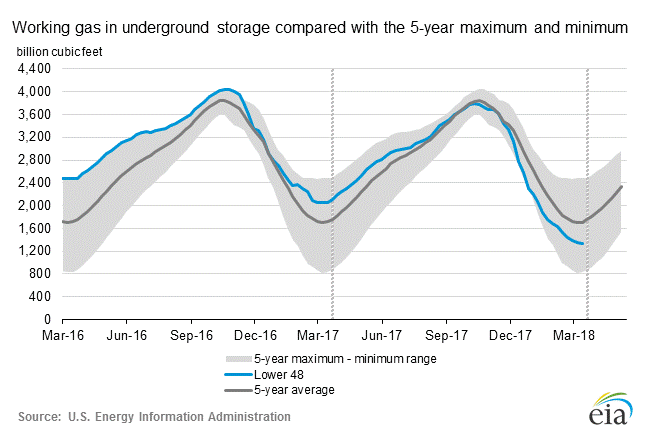

Natural Gas Inventory

Natural gas inventories are at their lowest level in four years.

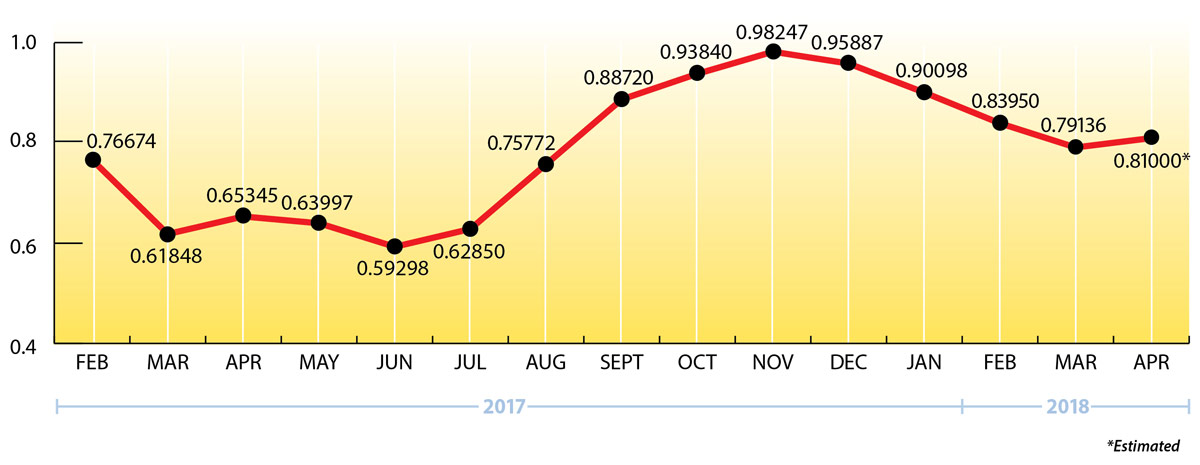

What’s happening with propane prices?

Total US propane inventories are also low: 9% behind last year, 48% behind 2016.

EIA weekly numbers:

US propane inventories for the week ending 4/13/18 were unchanged at 35.9 mmbbls. and stand 9% behind last year.

Conway, KS, inventories drew down 200K bbls. (9.0 mmbbls. total) and are 19% behind last year.

Mt. Belvieu, TX, inventories built by 200K bbls. (23.1 mmbbls. total) and are 5% behind last year.

The Skinny:

All signs point towards higher prices for crude oil, natural gas, and propane in the short term. It’s hard to argue against that.

But Permian Basin (west Texas) shale production is bursting at the seams. So we are likely to see record-shattering inventory builds this summer, especially since current price levels and very high hedge levels offer no impediment to strong production.

Thank you for your business. And please be assured, we are well positioned to take great care of your upcoming propane requirements.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our email newsletter here.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2017 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.