Will Bears Rule?

If a global crude glut hits, propane prices could swing—are you ready to capitalize?

You don’t need to travel to Admiralty Island in Alaska (known to the indigenous people as “fortress of bears”) to find a lot of bears. Simply watch or listen to the EIA, IEA and nearly every large investment banking institution talk about crude oil prices.

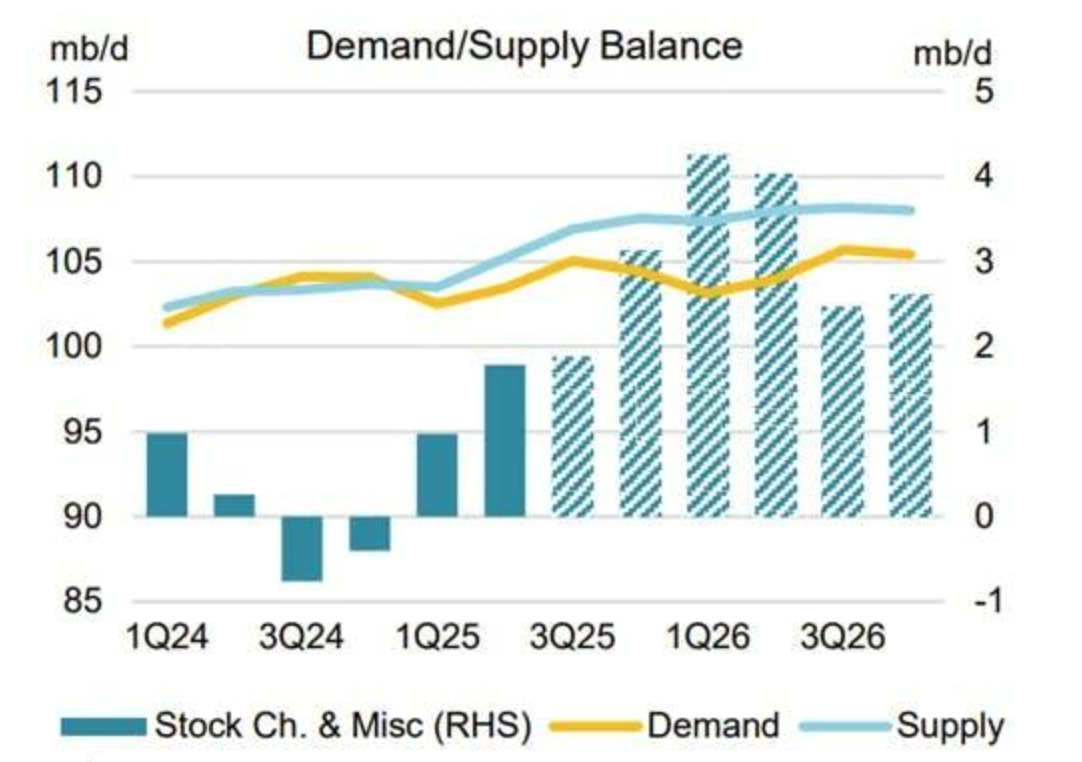

Bearish sentiment rules. The collective narrative is that strong demand growth for crude oil this year will be met by even stronger supply growth (about 3% greater than normal growth), which will lead to an oversupplied market.

But we haven’t seen any evidence of this happening yet!

Last week, for example, in their short-term energy outlook the EIA forecasted an average Brent crude price of $59/bbl. for Q4 2025, which equals roughly $55/bbl. WTI. That’s well below the low end of the current price range ($58/bbl. to $77/bbl.) this year.

Most of the crude oil forecasts predict a global supply glut developing in 2026 with plunging prices near $51.00/bbl. WTI.

(The International Energy Agency's latest oil market report points to a complex market influenced by increased OPEC+ output, potential supply disruptions from sanctions on Russia and Iran, and fluctuating demand.)

The Potential Math for Propane Prices:

If the pundits are right about their crude price forecasts for 2026, here’s the potential math for propane: $55 Brent = $51 WTI = $.58 Belvieu propane, which would be the lowest propane price in several years.

Low Prices Cure Low Prices

Perhaps it’s a contrarian viewpoint, but I think folks should approach 2026 crude oil price forecasts with caution and a full can of bear spray.

Firstly, the break-even economics for roughly 50 counties in the Permian Basin (the largest and lowest cost shale basin) is around $51/bbl. on average.

To their credit, U.S. producers are weathering the downturn by becoming leaner, more resilient and more efficient. But another leg down in crude prices could adversely impact domestic production, starting with the highest cost counties of each shale basin first.

Secondly, and perhaps most importantly, Saudi Arabia has a proven way to manage plunging crude prices and an oversupplied market; pump the brakes.

Opportunities for You!

Be ready to buy any price dips, not only for the balance of this contract season, but for the 2026/2027 contract season as well. After all, opportunities like this (which are driven by oversupply, rather than demand-destruction) don’t come along often and may not last long.

Especially given the fact that an increase of about 30% in new U.S. LPG export capacity is due to come on-line over the next few years.

The Skinny

The collective narrative in the petroleum world seems to be that strong demand growth for crude oil this year will be met by even stronger supply growth, which will lead to an oversupplied market.

I’m skeptical that we’ll see a prolonged period of crude oil prices in the low $50/bbl. range, and even more doubtful that we’ll see a sustained period of propane prices much under $.60/gallon.

During the 2019 pre-COVID propane price swoon, for example, crude prices were near $55/bbl. when Belvieu bottomed out near $.40/gallon and a super-low 30% value to crude in August. That was mostly due to U.S. export capacity constraints, which isn’t a factor now.

So, the best way to take advantage of any dips in the market is to lock in the price for a portion of your propane needs this winter, as well as the 2026/2027 contract season.

Ray Energy has the experience and the resources to take great care of your upcoming propane requirements. And as your trusted partner we’re here to help so please don’t hesitate to reach out to your Ray Energy representative whenever we can be of service.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2025 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.