Winter Propane: A Look Ahead

On the surface it appears that the U.S. now has a relatively high propane inventory level heading into winter. That’s certainly true, compared to last year.

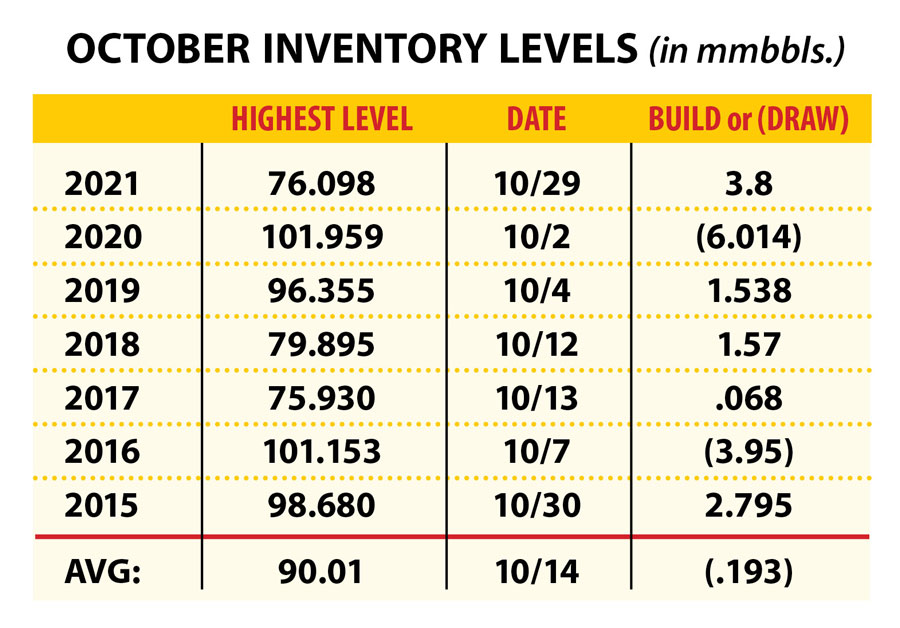

But as our chart below shows, 2021 was tied with 2017 for the lowest inventory level heading into winter since 2015, which is when the EIA first started excluding propylene at terminals from the propane inventory numbers.

The average of the high level marks is 90.01 mmbbls. We’re currently at 85.96 mmbbls. which is about average.

The build/draw column to the right also shows that October is typically a swing month; the build volume versus the draw volume is almost a wash.

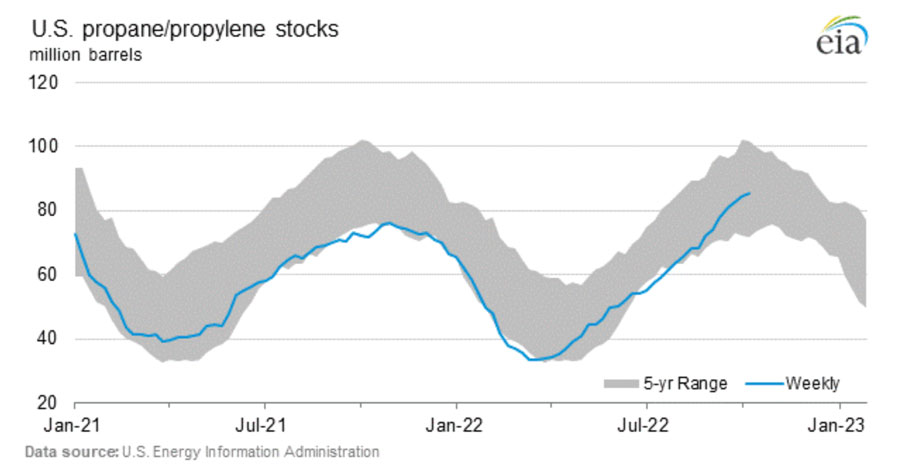

And here is the latest EIA chart (does not include today's small build) which shows that weekly propane inventory levels are still building, although they’ve been trending towards modest builds of late.

Inventory Levels.

But inventory levels don’t really tell the whole story, do they?

After all, most of the propane is stored in Mont Belvieu TX, (east of Houston) in underground salt caverns which contain the world’s largest propane storage. Belvieu acts like a giant “holding tank” since roughly 65 percent of total U.S. propane production is exported, mostly from the Gulf Coast.

And propane’s value to crude is on the low side (39 percent), which means something, as a low percentage to crude often translates to an increase in export and petrochemical demand within 60 to 90 days.

Why that may be important is that for the past two years it feels like there’s been a lag between supply and demand fundamentals. For example, demand picked up after COVID more quickly than supply could respond. And now we’re seeing record propane production from gas plants at the same time as we’re seeing reduced demand and falling prices.

It reminds me of my youngest daughter’s puppy, Amira, who is fond of chasing her tail.

Of course, we haven’t yet seen what winter has in store for us in the northern hemisphere. So it’s certainly possible that we’ll begin to see lower production numbers around the same time that we enter into a period of higher demand.

The Perennial Concern.

The perennial concern for most marketers is whether propane supply will be where it’s needed, when it’s needed, and that’s less about inventory levels and more about regional pricing and advanced planning.

After all, the highest priced regional markets will always attract additional propane supply if it’s needed. But advanced planning is also really important, especially during periods of strong demand. The more notice that you can give us when placing orders (many customers schedule a month in advance) the better we can serve you.

Winter 2023/2024 Fixed Prices.

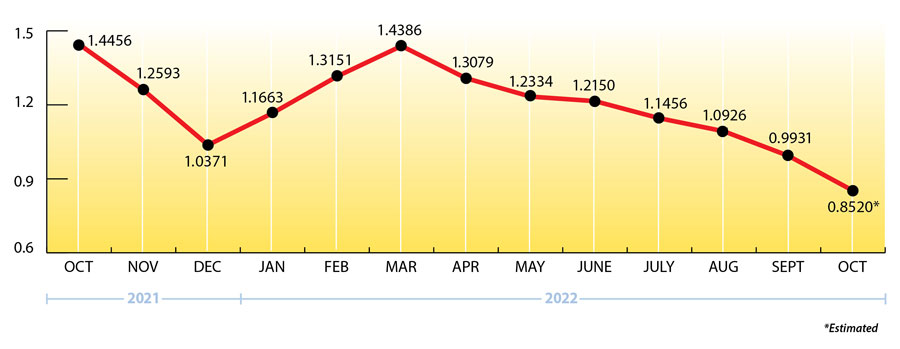

Current prices for next winter (October 2023 thru April 2024) are now about $.40 per gallon lower than this past winter and the lowest they've been in 22 months, so we’re starting to see some interest from customers wanting to lock in Mt. Belvieu pricing for winter 2023/2024.

We’d be glad to quote you, so please let us know if you’re interested.

What’s Happening with Propane Prices?

The market dropped nearly $.20 per gallon from the middle of September to the end of the month, which surprised a lot of folks, including me!

The global energy industry is in an unusual situation now where there are large supply imbalances (too long or too short) and lots of moving pieces between production, supply levels, transportation challenges, and take-away capacities that are impacting many countries and even specific regions (like the Permian Basin) within a country.

Propane Price Chart

Weekly Inventory Numbers

U.S. propane inventories showed a minimum build of .48 mmbbls. for the week ending October 14, 2022, below industry expectations.

This brings national inventory levels to 85.96 mmbbls., about 14 percent higher than last year and 2 percent above the 5-year average.

PADD 2 (Midwest/Conway) inventories had a small draw of .28 mmbbls. They currently stand at 24.58 mmbbls., nearly 2 percent lower than last year.

PADD 3 (Gulf Coast/Belvieu) inventories had a modest build of .37 mmbbls. They now stand at 47.49 mmbbls., roughly 34 percent ahead of last year.

The Skinny

At the moment, it looks like there are adequate propane inventory levels heading into winter and there are no pressing supply issues in any region of the country.

But as Mark Twain famously said, “If you don’t like the weather in New England now, just wait a few minutes.” The parallel for our industry, of course, is that change is constant when it comes to supply and demand, and the best way to prepare for change is to plan ahead and align yourself with an experienced, reliable supplier like Ray Energy.

Please be assured that we will be right by your side this winter, anticipating your needs and helping you meet your upcoming propane requirements with our strategic supply and exceptional customer service … come rain, sleet, or snow!

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2022 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.