Winter Propane Supply & Price Discussion

Is the Sky Falling?

There’s no shortage of reports of supply shortfalls and doom and gloom as we head into the winter months, so what happened? Should you be worried?

What Happened?

Since the worst part of the pandemic receded over a year ago, demand for energy has returned much faster than the production of energy.

In addition, oil producing countries and companies have been licking their wounds from the demand destruction in early 2020 which sent crude prices into negative territory and well counts plummeting, forcing some companies into bankruptcy. They’ve shown remarkable capital discipline during the recovery mostly for the benefit of their shareholders but also in response to lower future prices, OPEC restraint, and the current political climate regarding fossil-free energy policies.

After all, why would any energy company invest in an industry that’s being taxed and regulated out of business?

On top of everything else there’s a labor and materials shortage (this seems to be everywhere!), so it hasn’t been easy to ramp up.

All of this has created significant inventory deficits around the world. Storage levels in some places (especially natural gas in Europe) have reached historically low levels, which makes folks wonder: “If things are this bad now what will they be like in December or January?”

Are U.S. Propane Inventory Levels in Dire Shape?

It’s not quite “much ado about nothing” since national inventory levels are about 20 percent behind the five-year average, but much of the conversation about a propane shortage seems overblown to me. After all, the bulk of the U.S. supply deficit is in the Gulf Coast where most of the propane is earmarked for exports or as a feedstock for domestic petrochemical demand. Both draws on Gulf Coast supply can be reduced.

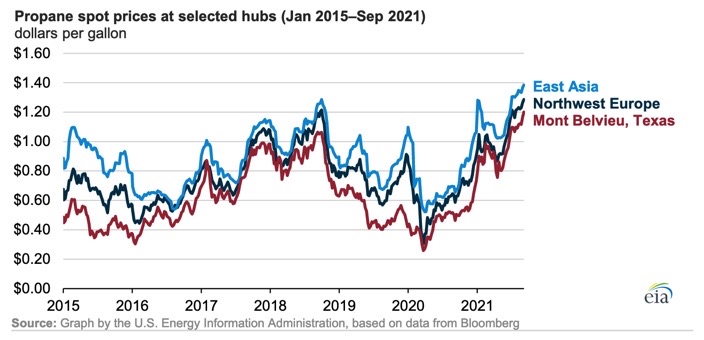

Here is a price chart from the EIA that compares spot prices in Mont Belvieu, TX, with Northwest Europe and East Asia. It illustrates the global nature of the recent surge in propane prices. It also shows that U.S. propane prices are lower than Europe and Asia, which is typical.

But what would happen if they weren’t lower?

Where are Propane Prices Going?

An energy trader in Tulsa once told me “If you can tell the difference between fear and greed, you can tell where the market is going.” The point of this simple advice is that fear drives prices higher, greed will drive prices lower.

Unfortunately, we are still in the “fear” stage. Let’s hope things don’t escalate to panic buying.

Last month, Goldman-Sachs revised their fourth quarter Brent forecast to $90.00 bbl. and Bank of America raised the spectre of $100.00 crude.

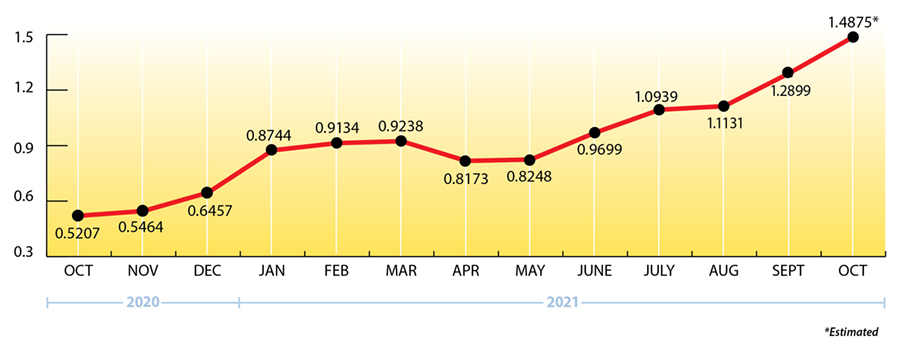

Here’s the math for propane:

$90.00 to $100.00 bbl. Brent = $87.00 to $97.00 bbl. WTI = $1.57 to $1.76 per gallon Belvieu propane at 76 percent value to crude.

The Cure?

The cure for price spikes is demand destruction and inventory building.

In terms of demand destruction, global petrochemical demand for propane as a feedstock should drop in favor of naphtha since propane’s percentage to crude is exceptionally high (76 percent), unless crude oil products get pulled into supplementing low natural gas supplies for power generation this winter.

Should You be Worried?

You should not be worried if you contracted your propane supply with Ray Energy. Why? We back-to-back the “wet gallons” for all of our supply contracts with physical supply contracts from the producers that make propane. We also have an extensive portfolio of diversified assets, multiple supply locations, and storage capabilities to assure you of an extremely reliable supply of propane.

Propane Price Chart

Weekly Inventory Numbers

U.S. propane inventories showed a draw of 0.6 mmbbls. for the week ending October 8, 2021. That brings national inventory levels to 71.7 mmbbls., about 28.2 percent behind last year and 20.8 percent behind the 5-year average

PADD 2 (Midwest/Conway) inventories had a draw of 0.3 mmbbls. They currently stand at 24.8 mmbbls., roughly 3.3 percent behind last year.

PADD 3 (Gulf Coast/Belvieu) inventories showed a build of 0.3 mmbbls. They now stand at 33.7 mmbbls., nearly 43.7 percent behind last year.

The Skinny

One of the root causes for the current global energy shortage is strong natural gas demand for electric power generation as countries and companies (cap and trade) reduce coal consumption but can’t fill the void with renewable energy sources.

There’s no question that countries in the Northern Hemisphere are heading into winter on pins and needles.

But it’s not too late to lock in the price on a portion of your winter volume. Current fixed prices are $.15 to $.35 per gallon lower than where Belvieu prices could be if the crude forecasts come true.

Get Stephen's insights on propane delivered to your inbox every month.

Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes. © 2011-2021 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.